- Home>

- Investment Plans>

- Online Savings Plan Plus

Trust of 20+ Years in Industry

Written bySumit Narula

Investment Writer

Published 16th December 2025

Reviewed byPrateek Pandey

Last Modified 9th January 2026

Investment Expert

5 Reasons to Buy this Online Savings Plan Plus

The following are the key benefits of Axis Max Life Online Savings Plan Plus (A Unit Linked Non Participating Individual Life Insurance Savings Plan | UIN: 104L131V01), crafted to suit your life stage and financial goals:

- 5 Plan variants to cater to different life stage needs

- Zero Allocation Charges

- Return of up to 150% of Administration charges*

- Secure Your Dreams – Get 1x, 2x, or 3x premium funding in case of life insured’s death&

- Extra Allocation for female life insured**

*A fixed percentage of total Policy Administration Charges deducted shall be added back as Return of Policy Administration Charge to the Fund Value at maturity or at end of (85 – Age at entry)th policy year, whichever is earlier provided the policy is in force and all due premium(s) have been paid. For policy term (PT) < 15 years, 125% of total Policy Administration charges deducted shall be added back and For policy term (PT) >= 15 years, 150% of total Policy Administration charge deducted shall be added back.

&In case of death of life insured, company will fund 1, 2 or 3 times of all the future outstanding Premiums for Gold Variant, Platinum Variant or Titanium variant respectively, as and when due under the Policy.

**Women Empowerment Benefit: An amount equivalent to 1% of the Annualized Premium under Limited/Regular Pay or 0.50% of the Single Premium under Single Pay shall be added to the Fund Value at the time of allocation of the first policy year’s premium or Single Premium, as applicable.

What do You Get with Online Savings Plan Plus?

1. Flexible Policy Term and Premium Payments

You can choose your policy term and premium payment frequency/premium payment term in line with your financial goals.

2. Customisations based on Your Risk Appetite

You can choose from 5 investment strategies and 22 different funds based on your risk appetite to optimize potential returns from the ULIP.

3. Unlimited Free Fund Switches & premium redirection

You can leverage market fluctuations

4. Enhanced Protection with Riders

You can opt for add-ons such as the Critical Illness and Disability Secure Rider and Smart Ultra Protect Rider to optimize your base life cover.

5. Liquidity through Smart Withdrawal Option

You can avail systematic money withdrawals as per your desire by withdrawing money regularly from your policy.

All You Need to Know about Axis Max Life Online Savings Plan Plus

The following are the key details of Axis Max Life Online Savings Plan Plus:

1. Plan Benefits

a. Maturity Benefit

On maturity, you will receive an amount, provided settlement option has not been exercised, equal to the Fund Value as applicable on the date of maturity of the policy. The Fund Value will be calculated as:

Fund Value = Summation of the Number of Units in Fund(s) multiplied by the respective NAV of the Fund(s) as on the date of maturity.

b. Death Benefit

| Under Wealth Variant & Wealth Whole Life Variant | On death of the Life Insured anytime during the policy term, provided the risk cover under the Policy is in-force, the nominee shall get higher of the following benefits:

The policy will then terminate on the death of Life Insured. Please note that the ‘applicable partial withdrawals’ mentioned above refers to all the partial withdrawals (including Smart Withdrawals) made during the last two years immediately preceding the death of the Life Insured. Further, any applicable charges other than Fund Management Charges (FMC) recovered after the date of death shall be added back to the fund value as available on the date of intimation of death. |

| Under Gold Variant, Platinum Variant & Titanium Variant | On death of the Life Insured anytime during the policy term, the nominee shall get the following benefits:

|

c. Tax Benefits

Tax benefits may be applicable on premiums paid and benefits received as per prevailing tax laws.

d. Return of Policy Administration Charges

Payable at the end of the policy term (i.e at maturity) or at the end of (85 minus Age at Entry)th policy year, whichever is earlier provided the policy is in force and all due premium(s) have been paid.

| Policy Term | For policy term (PT) < 15 years | For policy term (PT) >= 15 years |

| Return of Admin Charges | 125% of total admin charge deducted throughout PT (i.e. till maturity date) | 150% of total admin charge deducted throughout PT (i.e. till maturity date) |

The applicable Administration charges as mentioned above, will be added back as return of policy administration charges, to the Fund Value, (in the form of addition of units) at maturity or at the end of (85 minus Age at Entry)th policy year, whichever is earlier.

Note: For additional details, kindly refer to the product prospectus available under the Downloads section.

e. Women Empowerment Benefit

An amount equivalent to 1% of the Annualized Premium under Limited/Regular Pay or 0.50% of the Single Premium under Single Pay shall be added to the Fund Value at the time of allocation of the first policy year’s premium or Single Premium, as applicable. The allocation shall be made in accordance with the premium payment frequency of the annualized premium chosen at inception.

This Extra Allocation is exclusively available for female lives and shall be applicable under all the variants and all Premium payment terms.

Note: For additional details, kindly refer to the policy prospectus available under the Downloads section.

f. Existing Customer Benefit (ECB)

This is an additional booster only for Existing customers wherein a fixed percentage of Annualized/Single Premium shall be payable at the end of Policy Term (i.e. on Maturity) or at end of (85 minus Age at entry)th policy year, whichever is earlier provided all due premium(s) have been paid. This benefit shall be available under all the variants of this product subject to eligibility conditions.

The booster percentage shall be as follows:

| Policy Term | Existing Customer Benefit |

|---|---|

| Policy term < 20 | 2.5% of annualized/ Single premium |

| Policy Term > = 20 | 5% of annualized/Single premium |

Note: For additional details, kindly refer to the policy prospectus available under the Downloads section.

g. Premium Reduction Benefit

The policyholder, on completion of first five policy years, has an option to decrease the premium up to 50% of the original Annualized Premium, subject to the minimum premium limit, provided all due premiums have been paid. The policyholder must inform the Company of the decision to exercise this option, at least 15 days prior to the premium due date.

Note: For additional details, kindly refer to the policy prospectus available under the Downloads section.

h. Wellness Benefit

Axis Max Life Online Savings Plan Plus provides you with an option to take Health Management Services such as medical second opinion, medical case management, medical consultation, and discounts on medicines from the service providers registered with the company.

These wellness services can help you (the life assured) to get correct diagnosis of any medical condition and to procure appropriate care.

You can avail this feature only if the policy is in-force and all premiums have been paid up-to-date.

2. How This Plan Works

Let us understand the product benefits better with a few illustrations.

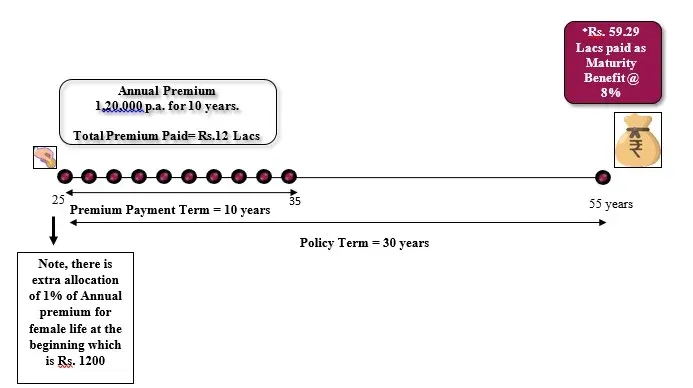

Example 1 (Wealth Variant):

Ms. Sharma, a 25-year-old professional who has recently started her career in an MNC, wants to begin investing early so she can build a sizable corpus by the time she turns 55. Her goal is to purchase her dream car in the future, and she wants to ensure that in case of an unfortunate event, her parents receive a lump-sum amount that can support their peaceful retirement. She decides to invest ₹1,20,000 annually for 10 years in High Growth Fund II (100%), and the policy term is of 30 years, Cover multiple: 10 times of Annualized Premium:

Total Additions to fund during Policy Term

| Extra Allocation for female life (at the beginning) | Return of Policy Administration charges (at the end of policy term) |

|---|---|

| 1,200 | 1,94,400 |

Maturity Benefit

On survival till the end of the policy term (30th Policy year), below Maturity benefit will be payable:

| At Assumed Return | Fund Value |

|---|---|

| @ 8% | 59,29,333 |

| @ 4% | 23,05,474 |

Death Benefit

In case of Ms Sharma’s unfortunate death at the end of 5th policy year, a lump sum Death benefit of 12 Lacs shall be payable and policy will terminate thereafter.

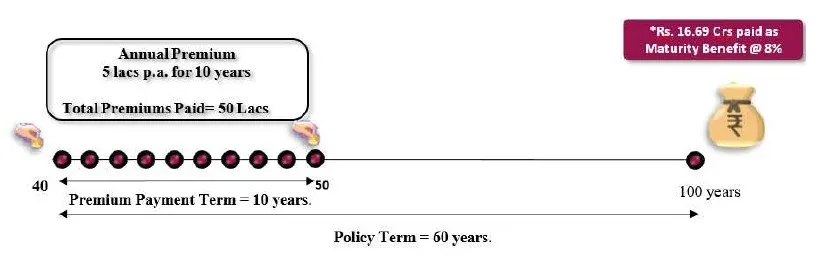

Example 2 (Wealth Whole Life Variant):

Rahul, a 40-year-old IT engineer, has invested in the Axis Max Life Online Savings Plan Plus–Wealth Whole Life variant to achieve his long-term life goals. He is paying an annual premium of ₹5,00,000 for a premium payment term of 10 years, with a Whole Life policy term. He has selected a sum assured of ₹50 lakhs, and over the course of the premium-paying period, his total premium will amount to ₹50,00,000. Let’s take a look at the benefits offered under this policy. Fund chosen: High Growth Fund II (100%), Cover Multiple chosen: 10 times of Annualized Premium, Sum Assured: 50 Lacs.

Total Additions to fund during Policy Term

| Return of Policy Administration charges (at the end of 45th policy year) |

|---|

| 4,05,000 |

Maturity Benefit:

On survival till the end of the policy term (60th Policy year), below Maturity benefit will be payable:

| At Assumed Return | Fund Value |

|---|---|

| @ 8% | 16,68,90,038 |

| @ 4% | 2,04,59,868 |

Death Benefit:

In case of Rahul’s unfortunate death at the end of 30th policy year, the Death Benefit, based on the assumed investment returns, are as per the table given below.

| At Assumed Return | Death Benefit |

|---|---|

| @ 8% | 2,48,36,446 |

| @ 4% | 92,83,025 |

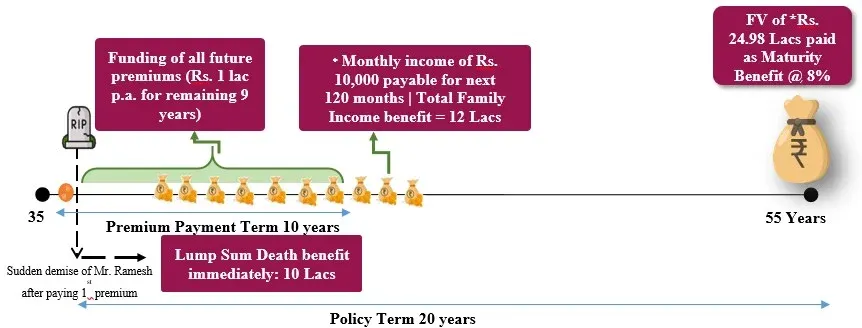

Example 3 (Gold Variant):

Ramesh is 35 years old and has a 3-year-old daughter. He wants to plan for her higher education. To achieve this, he has opted for Axis Max Life Online savings Plan Plus (Gold Variant).He has chosen a policy term of 20 years and pays an annual premium of ₹1,00,000 for a premium payment term of 10 years, with a Sum Assured of ₹10 lakhs (Cover multiple chosen 10x). Fund chosen: High Growth Fund II (100%)

Total Additions to fund during Policy Term

| Return of Policy Administration charges (at the end of policy term) |

|---|

| 1,08,000 |

Death Benefit:

In case of Ramesh’s unfortunate death at the end of 1st policy year, below Death Benefit shall be payable:

- Immediately: Lump Sum Death Benefit of Rs. 10 Lacs payable immediately; plus

- Family Income Benefit: A monthly income of 1% of SA. (1% of 10 Lac SA) = 10,000 shall be payable | For the above scenario, yearly, it amounts to 120% of the Annual premium, but it is paid in monthly installments only. Total Family Income Benefit payable is Rs. 12 Lacs; plus

- Funding of Premium: Funding of all future premiums for the remaining premium payment term and Fund Value as on the date of maturity will be paid at the end of the policy term.

Maturity Benefit:

On survival till the end of the policy term (20th Policy year), below Maturity benefit will be payable:

| At Assumed Return | Fund Value |

|---|---|

| @ 8% | 24,98,069 |

| @ 4% | 13,80,750 |

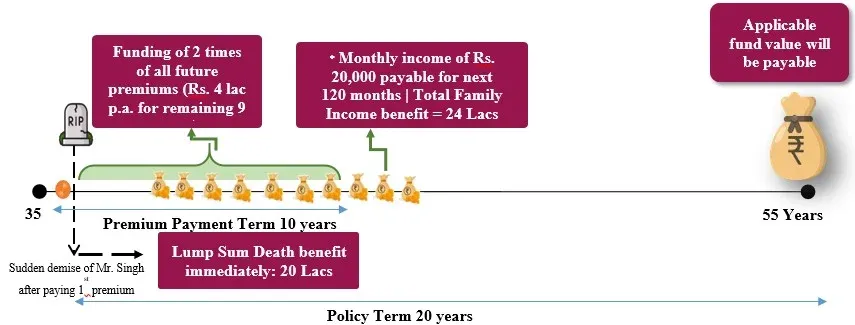

Example 4 (Platinum Variant):

Mr. Singh, a 35-year-old businessman and a newly proud father, wants to start investing so he can build a substantial corpus to gift his daughter when she gets married. To fulfil this goal, he approaches Axis Max Life and opts for the Online Savings Plan Plus (Platinum variant), which enables him to invest without any premium allocation charges. He chooses to invest ₹2,00,000 annually for 10 years and chooses the policy term of 20 years. 10 times of Annualized Premium. Fund chosen: High Growth Fund II (100%). Sum Assured: 20 Lacs.

Death Benefit:

In case of Mr. Singh’s unfortunate death at the end of 1st policy year, below Death Benefit shall be payable:

- Immediately: Lump Sum Death Benefit of Rs. 20 Lacs payable immediately; plus

- Family Income Benefit: A monthly income of 1% of SA. (1% of 20 Lac SA) = 20,000 shall be payable | For the above scenario, yearly, it amounts to 120% of the Annual premium, but it is paid in monthly installments only. Total Family Income Benefit payable is Rs. 24 Lacs; plus

- Funding of Premium: Funding of 2 times of all future premiums for the remaining premium payment term and applicable Fund Value as on the date of maturity will be paid at the end of the policy term.

Total Additions to fund during Policy Term

| Return of Policy Administration charges (at the end of policy term) |

|---|

| 1,80,000 |

Maturity Benefit:

On survival till the end of the policy term (20th Policy year), below Maturity benefit will be payable:

| At Assumed Return | Fund Value |

|---|---|

| @ 8% | 49,78,761 |

| @ 4% | 27,40,948 |

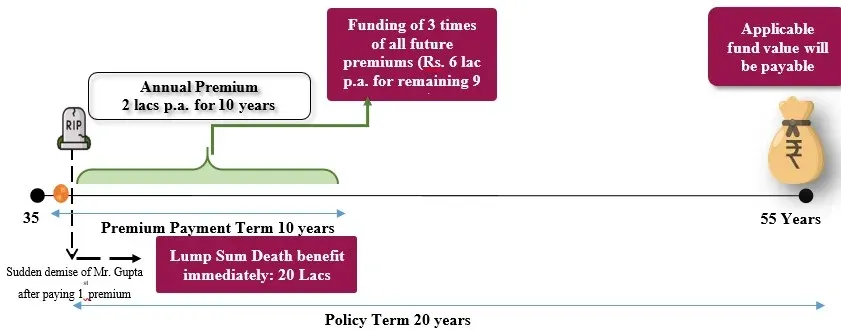

Example 5 (Titanium Variant):

Mr. Gupta, a 35-year-old professional and a newly proud father of a son. He wants to plan for his higher education wants to start investing so he can build a substantial corpus for the same. To fulfil this goal, he approaches Axis Max Life and opts for the Online Savings Plan Plus (Titanium variant), which enables him to invest without any premium allocation charges. He chooses to invest ₹2,00,000 annually for 10 years in High Growth Fund II (100%) and chooses the policy term of 20 years. Cover multiple chosen: 10 times of Annualized Premium. Sum Assured: 20 Lacs.

Death Benefit:

In case of Mr. Gupta’s unfortunate death at the end of 1st policy year, below Death Benefit shall be payable:

- Immediately: Lump Sum Death Benefit of Rs. 20 Lacs payable immediately; plus

- Funding of Premium: Funding of 3 times of all future premiums for the remaining premium payment term and applicable Fund Value as on the date of maturity will be paid at the end of the policy term.

Total Additions to fund during Policy Term

| Return of Policy Administration charges (at the end of policy term) |

|---|

| 1,80,000 |

Maturity Benefit:

On survival till the end of the policy term (20th Policy year), below Maturity benefit will be payable:

| At Assumed Return | Fund Value |

|---|---|

| @ 8% | 50,80,364 |

| @ 4% | 28,14,144 |

*Please note that the above assumed rates of return @ 4% and 8% p.a. respectively, for High Growth Fund II, are only scenarios at these rates after recovering all applicable charges. These are not guaranteed and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of the Funds is dependent on a number of factors including future investment performance. For more information, please request for your policy specific benefit illustration. Benefits payable provided the risk cover under the Policy is in-force.

Applicable Charges under Your Plan

- Premium Allocation Charge

- Policy Administration Charge

- Single Pay: From Year 1 till Year 10. From year 11 onwards, Policy Administration charge is equal to zero for all SP policies.

- Limited/Regular Pay: Throughout policy term or till the end of (85 less Age at entry)th policy year, whichever is earlier.

- Mortality Charge

- Fund Management Charge

Nil

The policy administration charge (as a percentage of annualized/single premium) will be deducted as per the table given below, subject to a capping of Rs. 500 per month:

| Premium Payment Option | Annualised/ Single Premium is less than Rs. 10,00,000 | Annualised/ Single Premium is greater than or equal to Rs. 10,00,000 |

|---|---|---|

| Single Pay | 0.10% per month | 0.05% per month |

| Limited Pay and Regular Pay | ||

The duration of Policy Administration Charge deduction shall vary with PPT option and is as follows:

This charge will be levied at each monthly anniversary by cancelling Units from the Unit Account starting from the date of commencement of Policy.

The charge will be levied on the basis of ‘Sum at Risk’ on every monthly anniversary by cancelling units from the unit account. The mortality charge on death benefit will be based on the attained age of the life insured.

Note: For additional details, kindly refer to the policy prospectus available under the Downloads section.

| Fund Name (SFIN) | FMC |

|---|---|

| Axis Max Life Growth Super Fund II ( SFIN: ULIF04217/12/25GROWTHSUPR104) | 1.35% |

| Axis Max Life High Growth Fund II (SFIN: ULIF04117/12/25HIGHGROWTH104) | 1.35% |

| Axis Max Life Diversified Equity Fund II (SFIN: ULIF04317/12/25DIVIEQUITY104) | 1.35% |

| Axis Max Life Growth Fund (SFIN:ULIF00125/06/04LIFEGROWTH104) | 1.25% |

| Axis Max Life Sustainable Equity Fund (SFIN:ULIF02505/10/21SUSTAINEQU104) | 1.25% |

| Axis Max Life Pure Growth Fund (SFIN: ULIF02630/12/22PUREGROWTH104) | 1.25% |

| Axis Max Life Midcap Momentum Index Fund (SFIN: ULIF02801/01/24MIDMOMENTM104) | 1.25% |

| Axis Max Life Nifty Alpha 50 Fund (SFIN: ULIF02914/05/24ALPHAFIFTY104) | 1.25% |

| Axis Max Life Nifty 500 Momentum 50 Fund (SFIN: ULIF03015/08/24MOMENFIFTY104) | 1.25% |

| Axis Max Life Nifty Momentum Quality 50 Fund (SFIN: ULIF03127/10/24MOMQUALITY104) | 1.25% |

| Axis Max Life Sustainable Wealth 50 Index Fund (SFIN:ULIF03223/12/24SUSTWEALTH104) | 1.25% |

| Axis Max Life Smart Innovation Fund (SFIN: ULIF03301/03/25INNOVATION104) | 1.25% |

| Axis Max Life Nifty 500 Multifactor 50 Index Fund (SFIN: ULIF03414/05/25MULTIFACTO104) | 1.25% |

| Axis Max Life BSE 500 Value 50 Index Fund (SFIN: ULIF03623/07/25BSEVALUEIN104) | 1.25% |

| Axis Max Life India Consumption Opportunities Fund (SFIN: ULIF03807/10/25/INDIACONSU104) | 1.25% |

| Axis Max Life BSE 500 Dividend leaders 50 Index Fund (SFIN: ULIF03907/11/25BSEDIVLEAD104) | 1.25% |

| Axis Max Life Balanced Fund (SFIN: ULIF00225/06/04LIFEBALANC104) | 1.10% |

| Axis Max Life NIFTY Smallcap Quality Index Fund (SFIN: ULIF02702/08/23NIFTYSMALL104) | 1.00% |

| Axis Max Life Dynamic Bond Fund (SFIN: ULIF02401/01/20LIFEDYNBOF104) | 0.90% |

| Axis Max Life Money Market II Fund (SFIN: ULIF02301/01/20LIFEMONMK2104) | 0.90% |

| Axis Max Life Secure Fund (SFIN: ULIF00425/06/04LIFESECURE104) | 0.90% |

| Axis Max Life Discontinuance Policy Fund (SFIN: ULIF02021/06/13LIFEDISCON104) | 0.50% |

3. Plans Variants and Eligibility

Axis Max Life Online Savings Plan Plus plan offers the following 5 variants. You can choose one plan variant at inception only. However, once you choose a variant at policy inception, you cannot change it later.

| S. No. | Plan Variant | Base Death Benefit | Funding of Premium | Family Income Benefit |

|---|---|---|---|---|

| 1. | Wealth Variant | Yes | No | No |

| 2. | Wealth Whole Life Variant | Yes | No | No |

| 3. | Gold Variant | Yes | Yes (1X) | Yes |

| 4. | Platinum Variant | Yes | Yes (2X) | Yes |

| 5. | Titanium Variant | Yes | Yes (3X) | No |

The following is the eligibility criteria for this plan:

Entry Age (age as on last birthday)

| Plan Variant | Premium payment option | Cover multiple | Minimum entry age | Maximum entry age |

|---|---|---|---|---|

| Wealth Variant | Single pay | 1.1 & 1.25 | 0 years (i.e. 31 days) | 65 years |

| 5 | 45 years | |||

| 7 | 40 years | |||

| 10 | 35 years | |||

| Limited/ Regular pay | 5 & 7 | 65 years | ||

| 10 | 63 years | |||

| 15 | 54 years | |||

| 20 | 42 years | |||

| Wealth Whole Life Variant | Limited pay | 5, 7 & 10 | 65 years | |

| 15 | 55 years | |||

| 20 | 42 years | |||

| Gold Variant | Limited/ Regular pay | 5, 7 | 18 years | 54 years |

| Platinum Variant | ||||

| Titanium Variant | 10 | 49 years |

Maturity Age

| Plan Variant | Premium payment option | Cover multiple | Minimum Maturity Age (Years) | Maximum Maturity Age (Years) |

|---|---|---|---|---|

| Wealth Variant | Single pay | 1.1 & 1.25 | 18 years | 85 years |

| 5 | 65 years | |||

| 7 | 60 years | |||

| 10 | 55 years | |||

| Limited/ Regular pay | All | 85 years | ||

| Wealth Whole Life Variant | Limited pay | All | 100 years | 100 years |

| Gold Variant | Limited/ Regular pay | All | 28 years | 64 years |

| Platinum Variant | ||||

| Titanium Variant |

Premium

| Plan Variant | Premium payment option | Minimum Premium (in Rs.) | Maximum Premium |

|---|---|---|---|

| Wealth Variant | Single pay | 200,000 | There is no limit on the maximum premium and the same shall be subject to the Board approved underwriting policy of the Company. |

| Limited/ Regular pay | Annually- 6,000 Semi Annually- 3,000 Quarterly- 1,500 Monthly - 500 | ||

| Wealth Whole Life Variant | Limited pay | ||

| Gold Variant | Limited/ Regular pay | ||

| Platinum Variant | |||

| Titanium Variant |

“Single Premium” is defined as the lump sum premium payable at inception of the policy excluding the taxes, rider premiums and underwriting extra premiums on riders, if any.

“Annualised Premium” means the premium amount payable in a year excluding taxes, rider premiums and underwriting extra premiums on riders, if any.

"Total premiums paid" means total of all the premiums received under the base product including top-ups premium paid, if any.

Note: For additional details, kindly refer to the policy prospectus available under the Downloads section.

Download Policy-related Documents

Policy Prospectus

Format: PDF|Size: 799 KB|Language: English

Policy Contract

Format: PDF|Size: 1 MB|Language: English

Customer Information Sheet

Format: PDF|Size: 260 KB|Language: English

Mortality Rates

Format: PDF|Size: 447 KB|Language: English

Fund Options and Their Performances

Note: Returns are 5-year compounded annualised growth rate (CAGR). Past performance is not indicative of future performance. Star rating is Overall Rating. Rating and returns are as on 31st December 2025.

"The Above mentioned Fund returns are after deduction of Fund Management Charges (FMC)"

In the unit linked insurance policies, investment risk in the investment portfolio is borne by the policy holder. Past performance is not necessarily indicative of future performance. The linked insurance products do not offer any liquidity during the first five years of the contract the policyholder will not be able to surrender/withdraw the monies invested in linked insurance products completely or partially till the end of fifth year. Returns are 5 year compounded annualised growth rate (CAGR). Rating and returns are as on 31st December 2025.

© 2020 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and its content providers; (2) may not be copied or redistributed except as specifically authorised; (3) do not constitute investment advice; (4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well as up.

The ‘Morningstar Overall Rating’ is a quantitative assessment of a fund’s past performance-both return and risk-as measured from one to five stars, with one (1) being the lowest and five (5) being the best as on 31st December 2025.

Additional Benefits through Riders

Axis Max Life Critical Illness and Disability Secure Rider (UIN: 104A034V02)

This rider provides benefit upon diagnosis of any of the critical illnesses covered.

Note: Please refer to Axis Max Life Critical Illness and Disability Secure Rider prospectus for more details.

Axis Max Life Smart Ultra Protect Rider (UIN: 104A049V02)

This rider provides following rider benefit variants:

- Rider benefit variant 1 - Term Booster with Accelerated Terminal Illness: provides additional lump sum benefit in the case of death or diagnosis of Terminal Illness of the Life Insured, whichever is earlier.

- Rider benefit variant 2 - Accidental Death Benefit: provides additional lump sum benefit in the case of death due to accident of the Life Insured.

- Rider benefit variant 3 - Accidental Total and Permanent Disability: provides additional lump sum benefit in the case of occurrence of total and permanent disability to the Life Insured due to accident.

- Rider benefit variant 4 – Payor Benefit: provides funding of all future outstanding base premiums and waiver of all the future premiums under all attached riders in the case of death or diagnosis of Terminal Illness of the policyholder whichever is earlier. This rider variant shall not be available for Gold/Platinum/Titanium variants.

Note: Please refer to Axis Max Life Smart Ultra Protect Rider prospectus for more details.

FAQs about Axis Max Life Online Savings Plan Plus

How is Axis Max Life Online Savings Plan Plus a Female Friendly Plan?

This plan is considered Female friendly, as it offers Women Empowerment Benefit, which is a Special benefit applicable only for Female lives. Here, an amount equivalent to 1% of the Annualized Premium under Limited/Regular Pay or 0.50% of the Single Premium under Single Pay shall be added to the Fund Value at the time of allocation of the first policy year’s premium or Single Premium, as applicable.

How does the Return of Policy Administration Charges work under this product?

Under Axis Max Life Online Savings Plan Plus, a fixed percentage of total Policy Administration Charges deducted shall be added back as Return of Policy Administration Charge to the Fund Value at maturity or at the end of (85 minus Age at Entry)th Policy year, whichever is earlier, provided the policy is in force and all due premium(s) have been paid.

| For policy term (PT) < 15 years | For policy term (PT) >= 15 years |

|---|---|

| 125% of total admin charge deducted throughout PT (i.e. till maturity date) | 150% of total admin charge deducted throughout PT (i.e. till maturity date) |

How many Partial withdrawals are allowed under Axis Max Life Online Savings Plan Plus in a year? What is the min. amount allowed for partial withdrawal?

No Partial Withdrawals are allowed in the first five (5) policy years, and thereafter, unlimited partial withdrawals are allowed in a policy year. There is no charge for partial withdrawals.

The minimum amount of partial withdrawal allowed per transaction is Rs. 5,000, provided the Life Assured is at least 18 years of age.

The minimum amount of partial withdrawal allowed per transaction is Rs. 5,000, provided the Life Assured is at least 18 years of age.

What is the Premium allocation charge applicable under Axis Max Life Online Savings Plan Plus?

There is No premium allocation charge applicable under this product.

How does Smart Withdrawal Option work in Axis Max Life Online Savings Plan Plus?

Smart Withdrawal Option is available under all variants of this Plan, where the policyholder can systematically withdraw money from his/her fund value and plan a secondary income as per their need, if all due premiums under the Policy have been paid.

You can choose to withdraw a pre-determined percentage of the fund value, subject to a maximum of 12% p.a. This Option can be chosen at policy inception or later anytime during the policy term.

For more details, please refer to the product prospectus.

You can choose to withdraw a pre-determined percentage of the fund value, subject to a maximum of 12% p.a. This Option can be chosen at policy inception or later anytime during the policy term.

For more details, please refer to the product prospectus.

ARN: PDP/OSPP/231225

Why Choose Axis Max Life Insurance?

Online Sales Helpline

- Whatsapp: 7428396005Send ‘Quick Help’ from your registered mobile number

- Phone: 0124 648 890009:30 AM to 06:30 PM

(Monday to Sunday except National Holidays) - service.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.

Customer Service

- Whatsapp: 7428396005Send ‘Hi’ from your registered mobile number

- 1860 120 55779:00 AM to 6:00 PM

(Monday to Saturday) - service.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.

NRI Helpdesk

- +91 11 71025900, +91 11 61329950 (Available 24X7 Monday to Sunday)

- nri.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.