You did it!

Here's how you performed

You're making informed choices!

Being well informed puts you in a stronger position to plan for life's uncertainties.

Term insurance is the simplest and purest form of life insurance, offering financial coverage to the policyholder against fixed premiums for a specified duration – hence the name term life insurance plan. Choosing and investing in the best term insurance plan is of utmost importance to anyone who has dependents and the best term insurance plan in India provides security as well as value for money. The premium for the term life insurance plans depend on various crucial factors including age, gender, premium payment term, policy term, sum assured, etc. chosen by you and policy term show less...Read More

Term insurance is the simplest and purest form of life insurance, offering financial coverage to the policyholder against fixed premiums for a specified duration – hence the name term life insurance plan. Choosing and investing in the best term insurance plan is of utmost importance to anyone who has dependents and the best term insurance plan in India provides security as well as value for money. The premium for the term life insurance plans depend on various crucial factors including age, gender, premium payment term, policy term, sum assured, etc. chosen by you and policy term show less...Read More

A term insurance policy can be defined is an agreement between a policyholder and an insurance company. As part of this agreement, the insurance company agrees to provide financial protection to the dependent (s) /nominee(s) of the life insured in the form of death and/or income benefits in return for premium payments, if certain specified events occur. Below are the key steps of how a term insurance plan works:

20 YearsAmrit, a non-smoker, selects a Life Cover Policy with a coverage amount of ₹1 crore for a term.

20 YearsAmrit, a non-smoker, selects a Life Cover Policy with a coverage amount of ₹1 crore for a term. 20 - 60 YearsAmrit consistently pays the premium on time.

20 - 60 YearsAmrit consistently pays the premium on time. Amrit's WifeThe Nominee gets ₹1 crore amount in one go.

Amrit's WifeThe Nominee gets ₹1 crore amount in one go. After ClaimHis wife can use the benefit amount to keep up with her current lifestyle.

After ClaimHis wife can use the benefit amount to keep up with her current lifestyle. Identity, address and demographic details such as age, gender

Identity, address and demographic details such as age, gender Medical history and current medical conditions, if any

Medical history and current medical conditions, if any Life style habits such as tobacco usage, alcohol intake, etc.

Life style habits such as tobacco usage, alcohol intake, etc. Profession/trade and annual income

Profession/trade and annual income Size of Life Cover -

It is suggested that the term insurance plan cover should be at least 10 times the annual income of the life insured. However, a higher life cover amount of up to 20 times the annual income is preferable for enhanced coverage.

Size of Life Cover -

It is suggested that the term insurance plan cover should be at least 10 times the annual income of the life insured. However, a higher life cover amount of up to 20 times the annual income is preferable for enhanced coverage.

Duration of Policy Term -

A longer policy term means that the interests of your dependent (s) /nominee(s) will be protected for a longer period of time. However, the premium payable will also be higher for longer policy terms. So one needs to weigh the affordability of the plan versus benefits for extended periods when making the decision.

Duration of Policy Term -

A longer policy term means that the interests of your dependent (s) /nominee(s) will be protected for a longer period of time. However, the premium payable will also be higher for longer policy terms. So one needs to weigh the affordability of the plan versus benefits for extended periods when making the decision.

Premium Payment Term -

Currently, term plans in India are offered with various premium payment terms such as regular pay. pay till 60 years, limited pay 10 years, limited pay 5 years and so on. If a shorter premium payment term is chosen versus require.

Premium Payment Term -

Currently, term plans in India are offered with various premium payment terms such as regular pay. pay till 60 years, limited pay 10 years, limited pay 5 years and so on. If a shorter premium payment term is chosen versus require.

Payout Options -

The payout options available with a term insurance policy can be broadly classified into 3 categories lump sum payout, periodic income payout (monthly, quarterly, bi-annually, etc.) or a combination of both. Depending on the protection needs of your loved ones, you can choose any of these.

Payout Options -

The payout options available with a term insurance policy can be broadly classified into 3 categories lump sum payout, periodic income payout (monthly, quarterly, bi-annually, etc.) or a combination of both. Depending on the protection needs of your loved ones, you can choose any of these.

A lump sum payout tone nominee (s) in case of death of the life insured during the policy term.

A lump sum payout tone nominee (s) in case of death of the life insured during the policy term. Receipt of regular monthly income instead of/along with lump sum payment based on the variant opted.

Receipt of regular monthly income instead of/along with lump sum payment based on the variant opted. Payout from riders opted to enhance protection in case of accidental death, disability, or diagnosis of specified critical illnesses.

Payout from riders opted to enhance protection in case of accidental death, disability, or diagnosis of specified critical illnesses.

Vaibhav Kumar

Insurance Domain Expert

Directly from Expert

At Axis Max Life, we value your Life and tailor our term Insurance products keeping all crucial factors in mind. Choose from our term plan options suiting your financial commitments, dependents, gender and income. You can take a step forward by paying as low as Rs. 595 monthly@7 and secure your family.

Government introduced GST reforms 2.0 on 4th September 2025 in which GST on all insurance policies was removed effective from 22nd September 2025. The latest move to remove GST for all existing term insurance policies as well as term plans for new buyers directly reduces the overall amount paid for the term plan. Earlier, policyholders had to pay 18% GST on their total premium, significantly increasing the cost.

The recent GST changes have brought term life insurance plans GST to 0%, and given a major boost to the insurance industry while encouraging buyers. This will not only lead to higher penetration of insurance throughout India, but also ensure that financial health of every family is protected.

Earlier, policyholders had to pay 18% GST on term insurance premiums, resulting in higher total cost of protection. With GST now removed, term insurance has become more affordable than ever for millions of families.

For example, if someone was paying ₹10,000 (₹8474.60 base premium + ₹1525.40 GST) annually earlier, the same plan could now cost ₹8,474.60. This essentially means overall cost of term insurance premium has become cheaper, especially for young earners and middle-income families.

A country where life insurance awareness is growing but coverage is still low, this GST reform will prove to be beneficial.

0% GST Benefit

Protect your Family's Future Now

₹1 Crore

Term insurance is that form of life insurance that is most easy to understand. There are several advantageous features of a term plan that you should know before buying one.

Choosing a term life insurance plan means understanding the key details: coverage amounts, premium, benefits, and your rights as a policyholder.

| Feature | Specification |

|---|---|

| Sum Assured (Life Cover) | ₹5 lakh to ₹20 crore (varies by insurer and income eligibility) |

| Policy Term | 5 to 40 years (can extend up to age 85-99 in some plans) |

| Premium Payment Options | Regular Pay, Limited Pay, or Single Premium |

| GST on Premiums | 0% GST |

| Death Benefit | Lump-sum payout to nominee on policyholder’s death during policy term |

| Maturity Benefit | Not applicable for pure protection plan. Available only if Return of Premium (ROP) option chosen |

| Critical Illness Rider | Covers major illnesses like cancer, heart attack, stroke, etc. |

| Accidental Death and Dismemberment Rider | Life Insured dies due to an accident, the rider sum assured is paid. |

| Terminal Illness Rider | Premiums eligible under Section 80C, payout exempt under Section 10(10D) of the Income Tax Act |

| Death Claims Paid Ratio | Axis Max Life’s Death claims paid ratio is 99.70%^ |

| Free-look Period | 15 to 30 days |

| Grace Period for Premium Payment | 15 days to 30 days |

| Policy Revival Period | Up to 2 years (subject to insurer’s terms) |

| Medical Test Requirement | Depends on age, sum assured, and health profile |

| Inclusions in term insurance | Exclusions in term insurance |

|---|---|

| Accidental death | Death due to suicide |

| Natural death | Death due to participation in war or terrorism |

| Death due to illness, such as cancer, heart disease, or stroke. | Death due to criminal activities |

| Permanent disability | Death under the influence of alcohol or drugs |

Just like there are various types of life insurance available in the market, similarly, there are different types of term insurance plans available too. While the basic benefits and features remain the same across all term insurance plan variants, there are some additional features that different one from another. These are explained in the table below:

| No | Plan Variants | Benefits in Brief |

|---|---|---|

| 1 | Basic Term Plan | Death benefit in a lump sum amount for an affordable premium |

| 2 | Term Insurance with Monthly Income | Regular stable income for family along with death benefit |

| 3 | Term Insurance with Growing Monthly Income | Growing income for family along with death benefit |

| 4 | Term Plan with Return of Premium | Return of premiums paid on maturity, along with death benefit during the policy period |

| 5 | Group Term Insurance | Life cover for a group of people under one policy |

| 6 | Level Premium Term Insurance Plan | Sum assured and premium remains unchanged throughout the policy term |

| 7 | Yearly Renewable Term Insurance | It is flexible and a short-term commitment |

| 8 | Decreasing Death Benefit Term Insurance Plan | Annual premium for this term insurance is significantly lower than regular term plan. |

| 9 | Increasing Death Benefit Term Insurance Plan | Useful to counter inflation or increasing future liabilities |

| 10 | Convertible Term Insurance Plan | Option to convert your term insurance policy into a permanent life cover at a later stage. |

| 11 | Joint Life Term Insurance Plan | An affordable option for couples who want to ensure the surviving partner is taken care of |

Choosing the right term life insurance plan means matching the policy type to your life stage, financial goals and risk profile. Let us understand the main types of term plans available for you in detail below.

‘Term life insurance’ or simply ‘term insurance’ is the purest form of life insurance, which offers financial protection for a specific period, typically 60 to 70 years of age, against a periodic premium. Such plans are designed to provide financial protection to your dependents in the event of your death. On the other hand, whole life insurance provides financial protection to an individual for up to 100 years of age as well as includes a component of savings that may accrue a particular cash value.

The following are some general differences between term life insurance and whole life insurance:

| Policy Parameter | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Term of the Policy | Term insurance typically has a policy term of 5 to 40 years. Hence it is called ‘term’ insurance | Whole life insurance policies offer coverage for whole life – up to 100 years of age. |

| Coverage | Term plans offer coverage in terms of ‘death benefit’ to fulfil and support the financial needs of your dependents in your absence. | Whole life plans are typically targeted at building funds to fulfil and support future lifestyle goals. |

| Maturity | Term plans do not offer a maturity benefit unless you choose return of premium (ROP) option in the beginning. | These plans generally offer a maturity value in cases when the insured outlives the policy term. |

| Additional Benefit | Term plans generally do not have additional/add-on benefits. | These plans allow you to choose participating option at policy inception, which provides you with bonuses along with the assured benefits. |

| Loan against the Policy | These plans do not offer any such benefit against the insurance policy | These plans allow you to apply for a loan against the policy. |

Securing your family in your absence should be your top priority and a term life insurance plan is the risk-free way to do so. Term plan ensures that the financial security of your family is maintained even after your death. Moreover, it does not affect your current lifestyle as it can be easily afforded given the coverage you’re opting for.

Also, you can easily understand the policy terms and choose your plan online with different insurance providers such as Axis Max Life Insurance, which offers a variety of term insurance plans in India. You can purchase a best term plan as per your requirements.

The claim settlement record of a life insurance company indicates the ultimate moment of truth for the customer. It can be assessed through a percent number (Claim Settlement Ratio) released by IRDAI (Insurance Regulatory and Development Authority India) every year.

Axis Max Life's death claims paid ratio for the year 2024-25 is 99.70%^.

Buying a term insurance plan is usually only the start of the story. You need to manage your term insurance policy to maximise the benefits. While the best term insurance plans can be feature-rich and affordable, the importance of providing a good customer experience cannot be overstated.

The customer service from life insurers can help the policyholders stick with them longer. Persistency Ratio declared by IRDAI annually can help you judge the insurer's service quotient.

Axis Max Life's 13th-month persistence has been 85%, which is a testament of the customer's satisfaction and loyalty towards the company*

(Source: Public Disclosure FY 2024-25)

Solvency ratio, as per its basic definition, the solvency ratio of an insurance company is the size of its capital relative to all risks it has taken. In other words, it represents the financial situation of the insurer as per solvency norms.

By checking solvency ratio of an insurer, you can identify whether the company has enough funds to settle claims in both long and short term.

Axis Max Life Insurance has a solvency ratio of 201%, which is way above the IRDAI mandate of 150% **.

(**Source: Public Disclosure FY 2024-25)

Death is not the only risk you need to cover against. Apparently, disability and life-threatening diseases can also damage your financial health. Adding rider which covers these benefits into your term insurance plan along with few additional value-added riders like 'critical illness cover' can ensure better financial backup.

Axis Max Life Insurance offers the benefit of Critical Illness coverage against 64 life-threatening health conditions as an additional benefit with Axis Max Life Smart Secure Plus Plan (A Non-Linked Non-Participating Individual Pure Risk Premium Life Insurance Plan (UIN: 104N118V11). Also, term insurance premiums are not as high compared to other types of life insurance plans. Hence. adding these rider as added benefits to your term insurance plan does not burden your pocket much.

Traditionally life insurance policies have been paying a large sum of money to the dependents of insured in case of any unforeseen circumstances. Often the dependents are not equipped to handle such a large sum of money to meet all their needs and goals. Term insurance plans also offer option to choose variant which offer as regular income options along with the lump sum so that they can look after their immediate needs while investing the lump sum for future goals.Thus, selecting a regular income payout option while buying a term insurance plan may save a lot of hassle for your dependents later.

Service quality is yet another parameter that you must consider while choosing an insurer to buy term insurance. You must know and ask about this quality from your peers or check online reviews to ensure that you are dealing with a renowned insurance company.

Also, you should check the online availability of the customer support team of an insurer for faster resolution of queries.

Another factor you can use to determine one of the best term insurance plan for yourself is on the basis of awards and recognition that a specific term insurance plan or insurer has received from reputed organisations. For example, Axis Max Life Insurance was awarded 'Best Term Plan Company' for Axis Max Life Online Term Plan Plus and 'Product of the Year'®️ award for Axis Max Life Smart Term Plan in the Term Life Insurance category in 2020.

Though the maximum and minimum ages may differ depending on the insurance provider you choose, major providers often accept a minimum entry age of 18 years and a maximum entry age of 65 years.

| Term Plan | Minimum Entry Age | Maximum Entry Age (age last birthday) |

|---|---|---|

| Axis Max Life Smart Term Plan Plus | 18 Year of Age | 40 Years of Age |

| Axis Max Life Smart Secure Plus Plan | 18 Year of Age |

For Non-POS: Regular Pay: 65 years Pay till 60: 44 years For POS: Regular Pay: 55 years Pay till 60: 44 years |

| Axis Max Life Smart Total Elite Protection Term Plan | 18 Year of Age |

Regular Pay and Limited Pay: 65 years Pay till 60: 44 years |

| Axis Max Life Saral Jeevan Bima | 18 Year of Age | 65 Years of Age |

Minimum age: For most Indian term insurance providers, minimum age is 18 years.

Maximum age: For most term plans, maximum age is 65 years.

Term insurance plans with flexible features, a strong solvency ratio, a high claim settlement ratio (CSR), and affordable premiums are considered the best value in India.

For instance, Axis Max Life Smart Term Plan Plus offers flexible features like return of premium, critical illness coverage, etc. Besides, the insurer has a CSR of 99.70%. Such plans offer the best value for policyholders seeking financial protection.

While choosing the best term insurance for a 30-year-old individual who has dependants and a tight budget, one should focus on affordable premiums and a reliable claim process.

Level term plans are ideal for such individuals, as they provide higher coverage at affordable premiums. Also, the premium and coverage stay the same (level) throughout the entire policy term.

When choosing term plans with or without medical tests, individuals should focus on their convenience as well as long-term financial security. Though plans with no medical tests seem attractive, as they do not involve procedures like health checkups, which can delay the procedure, they often provide lower coverage than those with medical tests.

So, before choosing between the two, one needs to evaluate beyond the premium rates.

| Feature | With Medical Tests | Without Medical Tests |

|---|---|---|

| Sum Assured | Usually higher coverage available | Coverage may be lower due to higher risk to insurer |

| Premium Cost | Generally lower premiums for healthy individuals | Slightly higher premiums to account for unknown health risks |

| Claim Certainty | Higher, as health status is verified upfront | Maybe slightly lower, as insurer has less information about health |

| Approval Time | Slightly longer, includes medical tests and verification. 1-2 days | Almost instant. |

| Riders Availability | Full range of riders usually available | Some riders may be limited or unavailable |

| Eligibility | May exclude individuals with serious pre-existing conditions | Easier eligibility; minimal health questions |

Before you decide to get a term insurance plan, it’s important to tick off a few factors that ensure you’re buying protection that works for your needs.

| Feature | Why it matters |

|---|---|

| Sufficient Sum Assured | Ensure cover meets income replacement and liabilities. |

| Policy Term/Tenure | Opt for a term that covers your earning years (e.g., until retirement) |

| Premium Affordability | The premium should fit your budget so you don’t risk lapse. |

| Insurer’s Claim Settlement Ratio & Solvency | Indicates reliability of insurer in paying claims. |

| Riders/Additional Benefits | Features like accidental death benefit, waiver of premium, critical illness add protection. |

| Coverage of Liabilities | Include outstanding loans, EMIs, home loan so your family isn’t burdened. |

| Inflation & Future Expenses | Consider rising costs (education, lifestyle) and inflation. |

| Disclosure of Health & Lifestyle | Honest disclosure avoids claim denial. |

| Premium Payment Mode & Flexibility | Annual vs monthly, single pay, choose structure that suits you. |

| Policy Exclusions & Terms | Read policy document for exclusions, waiting periods etc. |

Death, disability, disease, all the realities seldom talked about. However, all three are realities we cannot possibly overcome with certainty. Term insurance is one tool, which can save you and your family from the financial hardships brought upon by these three and similar disastrous conditions.

Term life insurance is essential for everyone who has a dependent. Individuals falling under following categories must have a term insurance to keep their families financially protected.

Taxpayers: If you are a salaried individual and pay taxes, a term plan offers both protection and tax benefits (under Section 80C and Section 10(10D).

Gen Z (Young Earners): If you are in your 20s or 30s, its the right time for you to buy a term insurance plan. Starting early means lower premium, and longer term coverage.

Individuals with debts: If you are someone who has already taken a home loan, car loan, personal loan, or has any other liability, you should get a term insurance plan.

Check Now - Home Loan Insurance Calculator

Sole bread-winner: If your spouse, children or parents depend on your income, term insurance will keep them protected.

New parents: With a child, you’ll want financial stability for their future even if the unexpected happens. You need a term plan if you are a new parent.

In short, if someone depends on your income, you carry loans or debts, you should strongly consider term insurance.

Hence, all individuals who have financial dependents should explore a suitable plan out of best term insurance policy.

The best time to buy a term insurance plan is as early as possible. When bought at a young age, preferably in one's 20s or early 30s, they can save significantly on the premium. This way, you get coverage for a longer duration at affordable premiums.

A 1 crore term plan bought at the age of 25 years by a healthy, non-smoker female might cost you somewhere around Rs. 1100 per month whereas the same 1 crore term plan purchased at the age of 45 years can cross Rs 3,000 monthly. So, if you delay in purchasing a term policy, you should be prepared to pay a higher premium. Therefore, to gain the maximum benefits of a term insurance plan, you should prefer to lock-in the low rates early in life.

The below table further illustrates why buying a term insurance plan at an early age can be beneficial. The below premium amounts are based on the assumption that the insured individual is covered till the age of 85 years:

| Age of the Life Insured | ₹1 crore life cover for healthy female non-smoker | ₹1 crore life cover for healthy female smoker | ₹1 crore life cover for healthy male non-smoker | ₹1 crore life cover for healthy male smoker |

|---|---|---|---|---|

| 25 years (PPT: 60 yr) | Total: 1090/Month Premium Payable: 7.43 lakh | Total: 1744/Month Premium Payable: 11.89 lakh | Total: 1284/Month Premium Payable: 8.75 lakh | Total: 2054/Month Premium Payable: 14.01 lakh |

| 35 years (PPT: 50 yr) | Total: 1815/Month Premium Payable: 10.32 lakh | Total: 2905/Month Premium Payable: 16.50 lakh | Total: 2245/Month Premium Payable: 12.76 lakh | Total: 3592/Month Premium Payable: 20.41 lakh |

| 45 years (PPT: 40 yr) | Total: 3163/Month Premium Payable: 14.38 lakh | Total: 5061/Month Premium Payable: 23.00 lakh | Total: 4143/Month Premium Payable: 18.83 lakh | Total: 6629/Month Premium Payable: 30.13 lakh |

| 55 years (PPT: 30 yr) | Total: 6314/Month Premium Payable: 21.52 lakh | Total: 10102/Month Premium Payable: 34.44 lakh | Total: 8574/Month Premium Payable: 29.23 lakh | Total: 13719/Month Premium Payable: 46.77 lakh |

Apart from selecting an adequate sum assured, there are several aspects which need to be kept in mind when finalising a term insurance plan. Check them out below:

'Policy term' refers to the duration of your insurance coverage. Choosing a longer tenure safeguards your dependants until they are financially independent. Here are some of the term plan options that you can choose based on the coverage duration:

Your age plays a crucial role in determining your term insurance premium as well as eligibility. To seek longer coverage at lower premiums, start your term insurance plan at an early age, preferably in your early 20s. Here are some of the term plan options based on an individual’s age:

It is ideal to select a term insurance coverage of 10-20 times your annual income. Salaried individuals can choose the sum assured amount as per their income range. Here are some of the term plan options based on salary:

Term plans cater to a diverse range of individuals, from families to employees and even NRIs. Check them out below:

Getting married, buying a house, having children, and planning for retirement are some of the major life events that not only bring joy but also impact your financial resources. Therefore, it's important to have a term life insurance plan so that your family is prepared to maintain the same standard of living even when you’re not around.

Below are some different life stages and how term life insurance plans help you with each of these:

NRIs can purchase a term life insurance policy in India under the FEMA (Foreign Exchange Management Act). Based on their requirements and demands, Indian insurance companies have customized term insurance plans for NRIs.

Here are the two different ways for NRIs to buy term life insurance in India:

Buying term insurance is an absolute cake walk. It’s quick and simple for anyone to buy. You should start by comparing different insurance providers and their plans. Look for some deciding factors like premium cost, coverage amount, claim settlement ratio etc. You can also check premium calculators to help you estimate the ideal coverage basis your income and liabilities, and dependents.

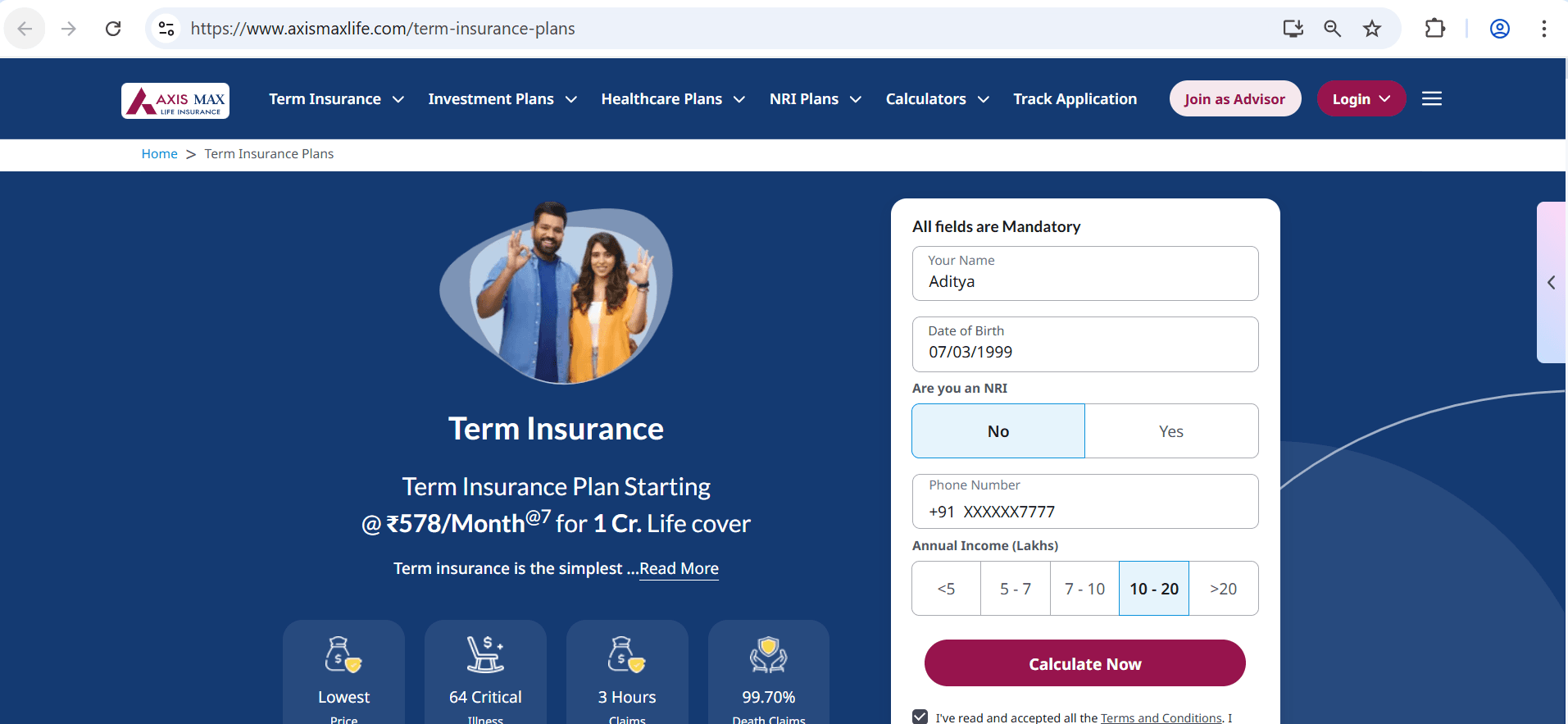

If you have decided to go with Axis Max Life Term Insurance, the process is completely digital. You need to fill in some of your personal details and pay online. In some cases, insurer might need you to share your medical reports to determine your premium. This is the step-by-step process to buy term insurance on Axis Max Life website.

This is the step-by-step process to buy term insurance on Axis Max Life website.

Buying term insurance online from Axis Max Life Insurance is quick and easy and can be done in a few simple steps. These include:

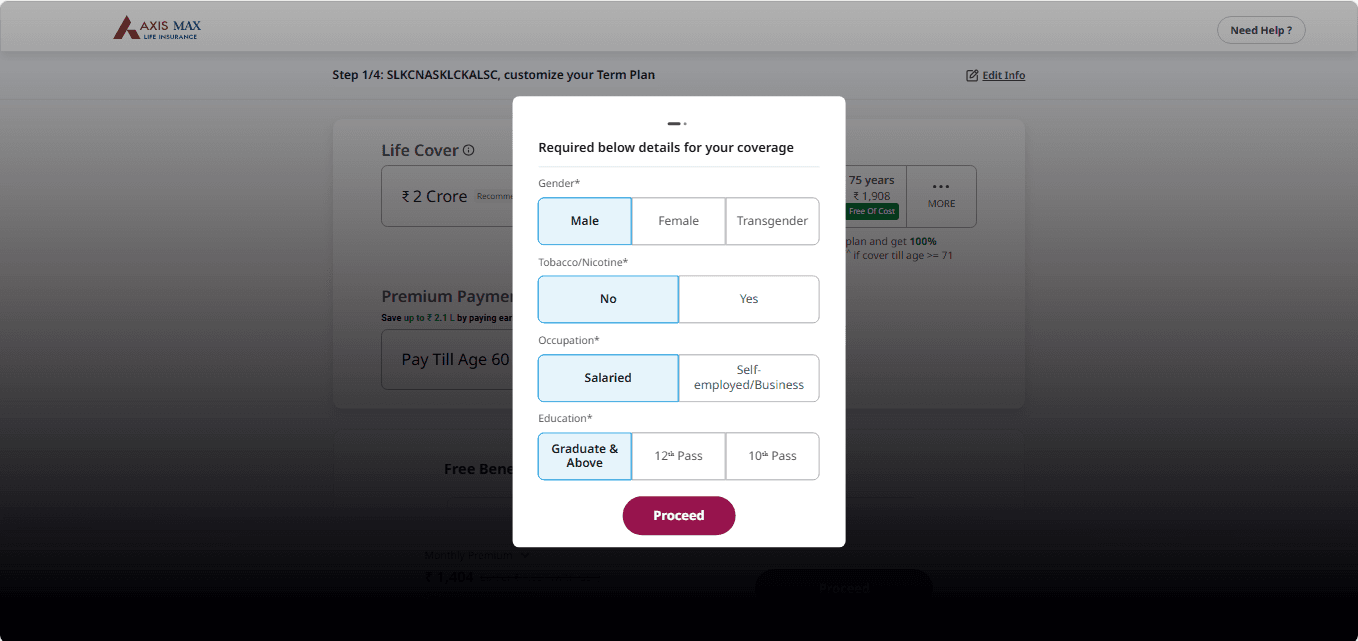

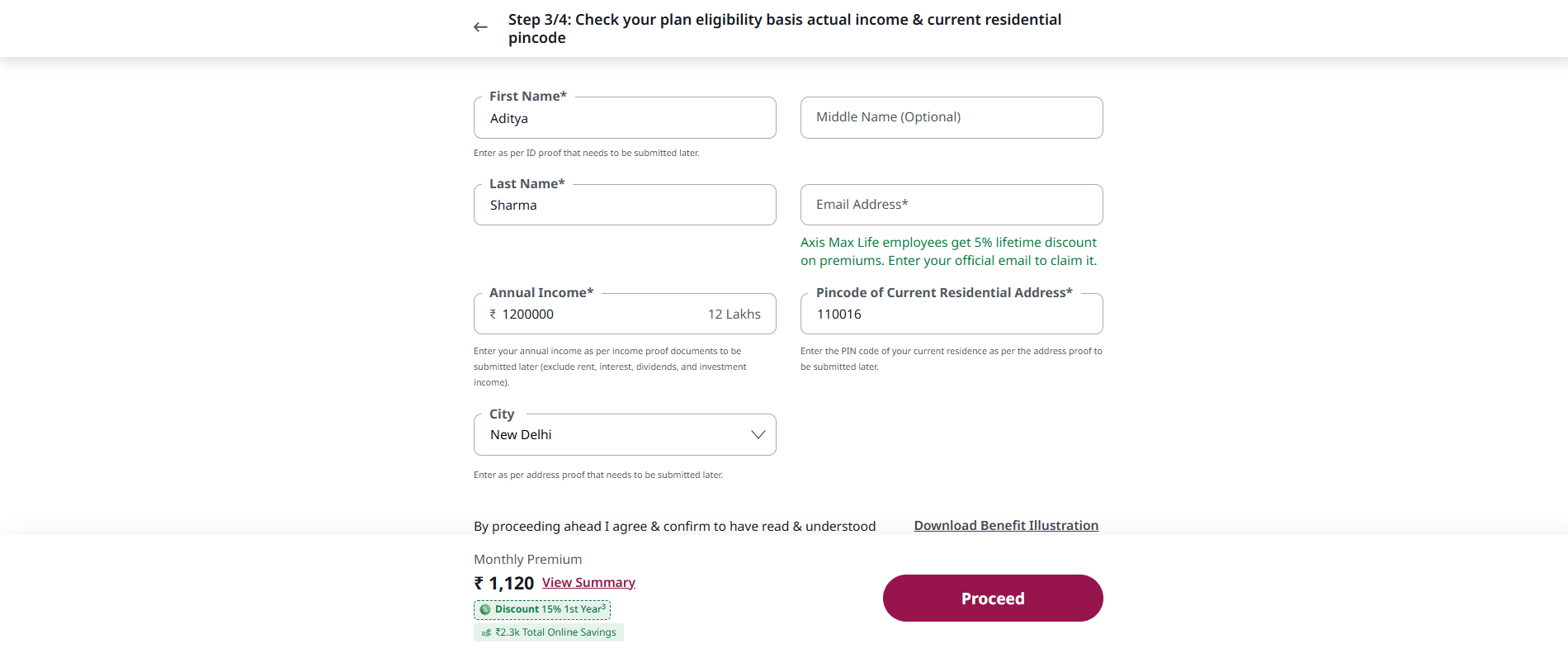

Step 1: Go to the top of the page & enter details like Name, Date of Birth, Nationality, Phone Number, & annual income. Click on 'Calculate Now' to move to the next step.

Step 2: Select your gender, lifestyle habit, occupation, education, marital status etc.

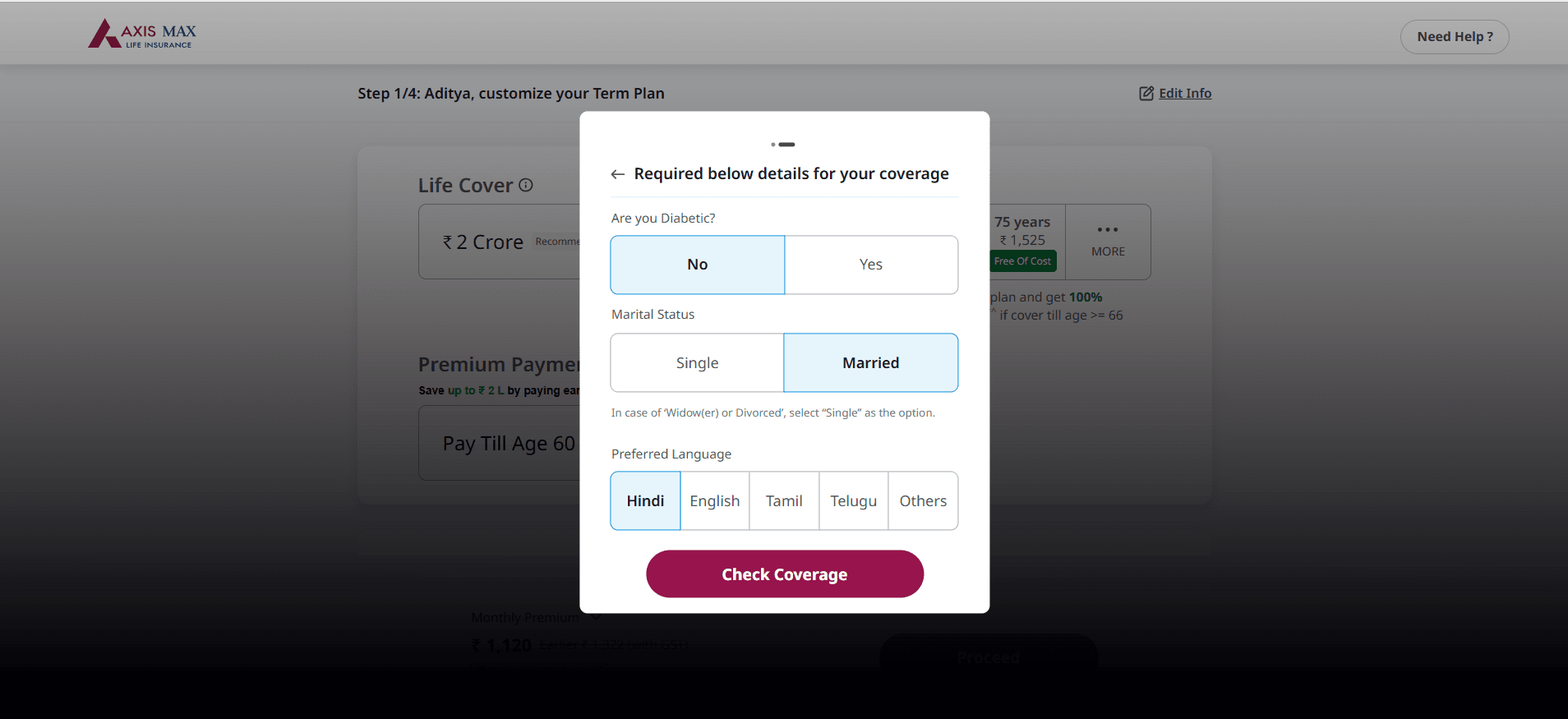

Step 3: Now select if you’re diabetic or not, your marital status, and language. Click on ‘Check Coverage’ button.

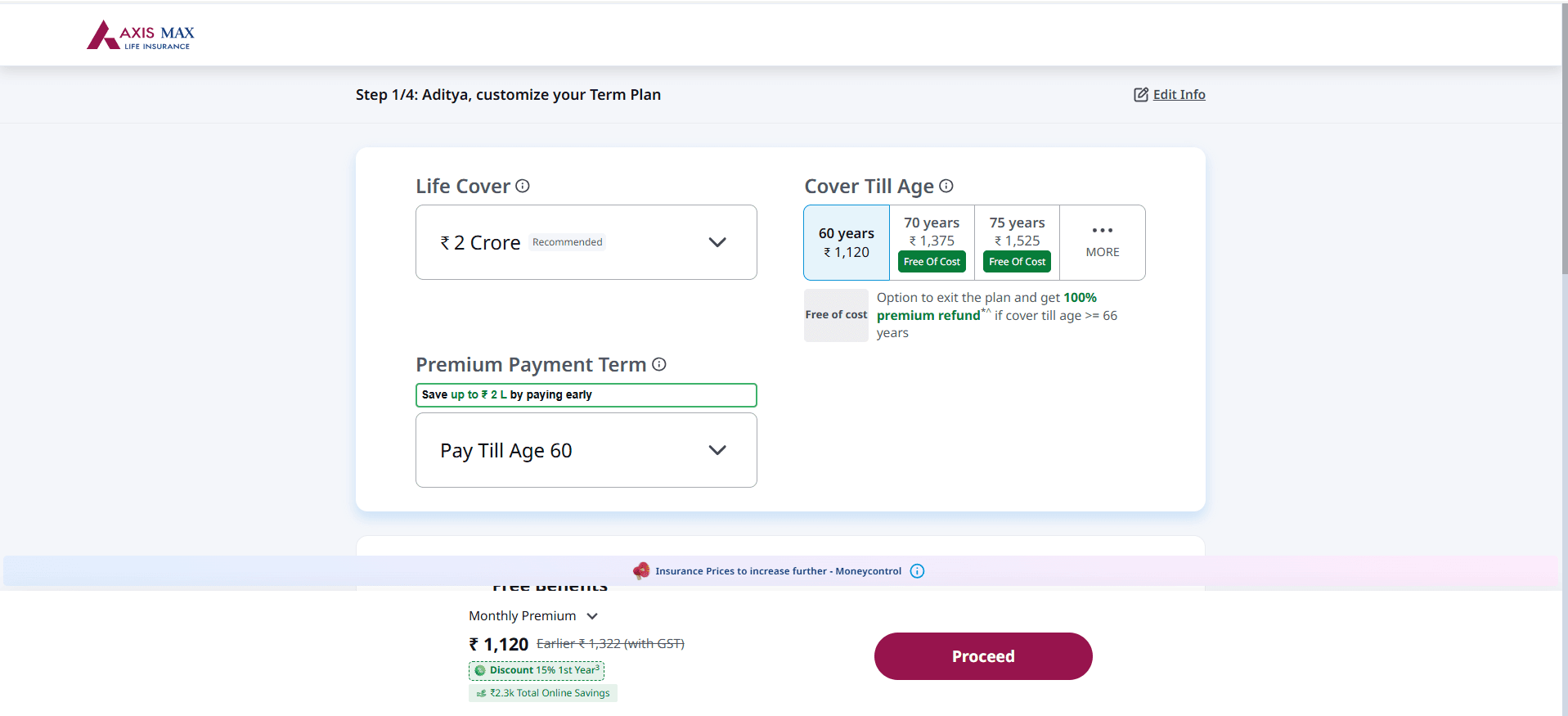

Step 4: On this screen, you can choose any life cover amount you want, and the duration of your coverage. Now click on ‘Proceed’.

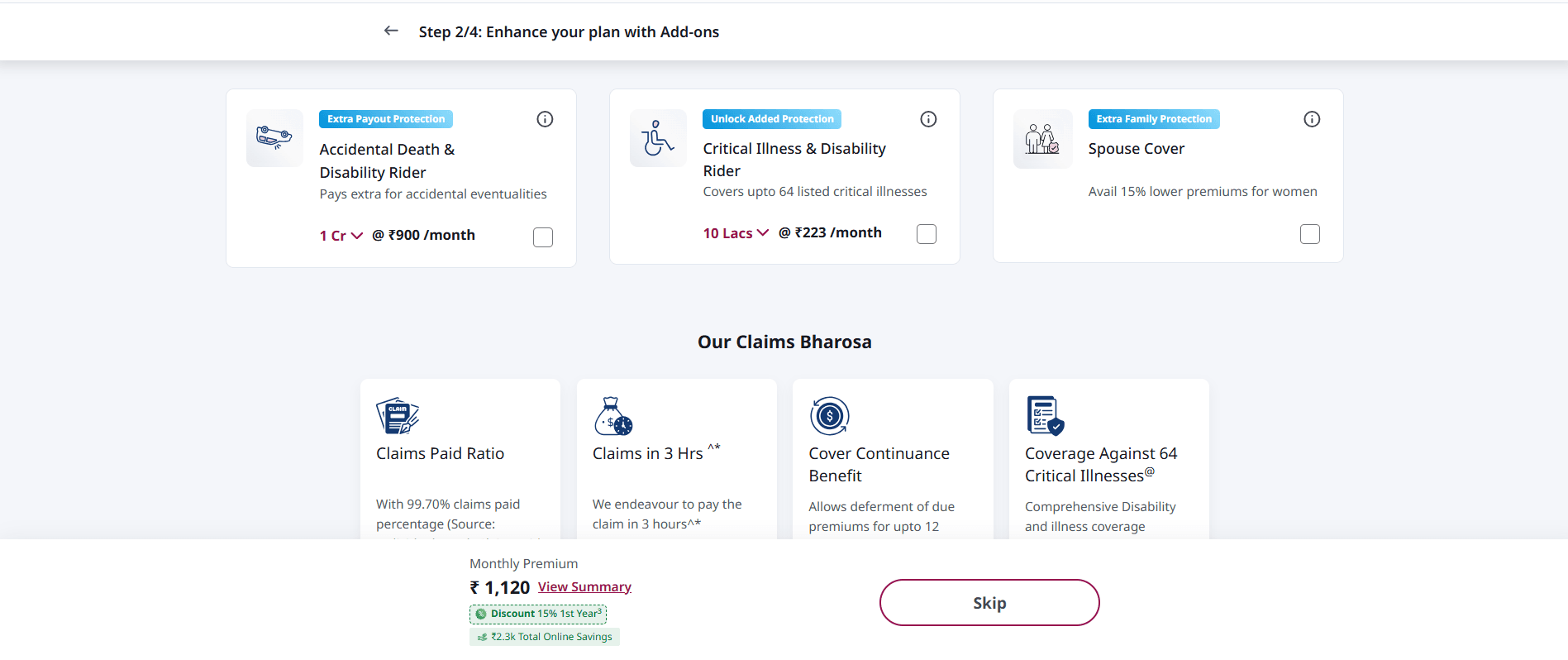

Step 5: Choose a rider or click on ‘Skip’ button. It’s recommended to choose a suitable rider to make your policy cover even more comprehensive.

Step 6: Enter all mandatory details to check your plan eligibility and click ‘Proceed’.

Step 7: In the next step, you have to make the payment. We will verify your documents. The policy document will be emailed to you after approval.

Here's how you performed

You're making informed choices!

Being well informed puts you in a stronger position to plan for life's uncertainties.

Here's how you performed

You've got the basics covered!

With a bit more learning, you can make even smarter insurance decisions.

Here's how you performed

Insurance can feel complex

But learning a little today can make a big difference tomorrow.

Below are the best term insurance plans available for policyholders, along with their features to help you make an informed decision.

| Product Type | Key Features |

|---|---|

| Plain Regular Term Insurance | Basic life-cover only; low premium; payout on death during policy term. |

| Term Insurance + Riders | Life-cover plus optional riders (critical illness, accidental death benefit, waiver of premium) for enhanced protection. |

| Group Term Insurance | Coverage provided through employer; usually lower cost; may cease when you leave job. |

| Whole Life Insurance | Life-cover for entire lifetime; higher premium; payout on death anytime. |

| Term Insurance with Monthly Income | Payout structured as monthly/regular income to nominee instead of lump-sum. |

| Level Premium Term Insurance Plan | Sum assured and premium remains unchanged throughout the policy term |

| Yearly Renewable Term Insurance | It is flexible and a short-term commitment |

| Decreasing Death Benefit Term Insurance Plan | Annual premium for this term insurance is significantly lower than regular term plan. |

| Convertible Term Insurance Plan | Option to convert your term insurance policy into a permanent life cover at a later stage. |

| Joint Life Term Insurance Plan | An affordable option for couples who want to ensure the surviving partner is taken care of |

| Increasing Death Benefit Term Insurance Plan | Useful to counter inflation or increasing future liabilities |

Here’s a quick overview of the Axis Max Life term plans for 2026, highlighting life coverage, age limit, and death claim settlement ratio.

| Sr. No. | Plan | Ideal for | Sum Assured | Premium | Unique Features | Explore Plan |

|---|---|---|---|---|---|---|

| 1. | Axis Max Life Smart Term Plan Plus | Salaried Individuals | 1 Crore | Starts at 595/Month@7 | A flat 15% discount applicable throughout the Premium Payment Term for Female Life Insured Available Riders: 1. Axis Max Life Waiver of Premium Plus Rider 2. Axis Max Life Critical Illness and Disability Rider 3. Axis Max Life Accidental Death and Dismemberment Rider | Read More |

| 2. | Axis Max Life Smart Total Elite Protection Term Plan | Salaried Individuals | 1 Crore | Starts at 745/Month^3 | The Policyholder is allowed to defer the due premium for a period of up to 12 months from the due date, while maintaining the full risk cover under the base plan and attached riders (if any), after completion of 3 policy years. Available Riders: 1. Axis Max Life Waiver of Premium Plus Rider 2. Axis Max Life Critical Illness and Disability Rider | Read More |

| 3. | Axis Max Life Smart Secure Plus Plan | Self-employed Individuals | 1 Crore | Starts at 987/Month9 | Offers joint life cover option for your spouse Available Riders: 1. Axis Max Life Waiver of Premium Plus Ride | Read More |

| 4. | Axis Max Life Saral Jeevan Bima | Low-income Individuals | 25 Lakh | Starts at 845/Month10 | Offers life coverage ranging from 5 to 25 lakhs to all individuals irrespective of their education or occupation. Available Riders: NA | Read More |

| No. | Types of Legal Entities | KYC Documents |

|---|---|---|

| 1. | Hindu Undivided Family (HUF) |

|

| 2. | Company |

|

| 3. | Partnership Firms, Trusts, etc. |

|

Passport

Passport Voter’s ID Card

Voter’s ID Card Driving License

Driving License Aadhaar Card

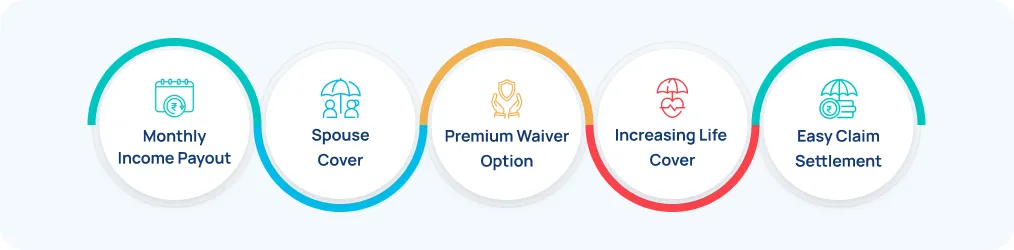

Aadhaar CardThe wide range of term plans with various features might make it difficult or a layman to determine which term insurance policy would be suitable to his/her unique needs. Below are some benefits of a term plan that one should look out for when making the final selection of a suitable term insurance plan:

Above are only a few of the key term insurance policy benefits that individuals should consider when comparing different term insurance policy options. One should keep in mind that very few, if any term plans in India currently offer all of these benefits, so one should take some time to consider factors such as affordability, insurance needs, financial goals, etc. before making the final decision.

Given the rising inflation and living costs, your term life insurance coverage should be at least 10 ten times your current income. However, the ideal coverage amount also depends on various factors like, future financial goals, income, age, liabilities, and lifestyle. Here is an overview of what to consider to check the right term life insurance cover for you:

Term insurance plans offer policyholders an option to pay a regular premium (monthly, quarterly, half-yearly, or annual), to get a life coverage amount. The payout options in term life insurance are defined into three categories:

Term insurance riders are affordable add-ons that enhance the basic life coverage offered by term insurance plans. The following are the 3 key benefits of term insurance riders:

They eliminate the need to invest in standalone insurance policies that might cause financial stress.

They eliminate the need to invest in standalone insurance policies that might cause financial stress. Riders in term insurance reduce the scope of out of pocket expenses in difficult times by ensuring sufficient medical coverage

Riders in term insurance reduce the scope of out of pocket expenses in difficult times by ensuring sufficient medical coverage Certain riders tax deductible, and you get tax deduction corresponding to the premium paid for the additional coverage

Certain riders tax deductible, and you get tax deduction corresponding to the premium paid for the additional coverage

Check the below list of some main riders that you can use with your term insurance:

Selecting the right term insurance policy is one of the best ways to provide financial security for your family. Hence, to make an informed term insurance purchase, here are some factors need to be considered:

Term life insurance premiums increase with age because health and mortality risk increases with your age. A person is less likely to die in his/her younger years than when in later life stages. Therefore, the risk of illness and death is increased.

Also, note that, as the customer's age increases, the qualifying medical exams also become stricter. So, it is best to buy a term insurance policy when you are young so that you can enjoy higher benefits for a lower premium.

The final stage of a term life insurance is the claim settlement. However, sometimes, the insurance claim gets rejected even after doing everything right as per you and paying premiums on time. Hence, it is important to take note of these important tips to know how to avoid of an insurance claim rejection later:

It is very important to reveal all the important personal and health details to the insurer. Common reasons for claim rejections are wrong disclosures, non-disclosures, or partial disclosures of important facts, like:

The process of filling the insurance form may seem time consuming, but make sure you don’t leave it to the insurance agent. Agents may disclose wrong details, so it’s important that you fill up the form yourself.

The another main reason that your claim gets rejected is non-payment of your premium. Hence, if you missed paying the premium on the specified time, make the payment within the grace period. By doing this, you will avoid claim rejection or any unintentional policy lapse.

Before purchasing the insurance plan, read carefully the terms and conditions on the policy document. When you are informed about all the policy rules, you have the option to negotiate on the clauses.

Most insurance providers have fixed deadlines for insurance claims. For example, some policies have a strict seven-day window, while some other policies may go up to 60-90 days, based on your insurance type. So, if you claim the insurance after the deadline, your claim will be rejected.

Hence, it’s good that you report the claim request when the details are fresh in your mind. This helps preserve critical information, increasing the chances of your claim being approved.

The claim settlement ratio for Axis Max Life Insurance is 99.70%^ for individual business policies.(Source: Individual Death Claim Paid Ratio as per audited financials for FY 2024-2025)

For Axis Max Life Insurance, solvency ratio is 201% for FY 2024-25. (Source: Public Disclosure FY 2024-25)

Term life insurance is a type of life insurance policy that offers the insured individual life cover for a fixed period of time known as policy term. The premium once decided at the time of policy purchase stays the same throughout the policy duration. With a pure term insurance plan, you get only life cover benefits payable on death of the insured individual whereas maturity benefit is not included. However, you can amplify the coverage with riders and add-ons such as a critical illness rider or a personal accident cover at a nominal cost.

In a pure term insurance policy, money-back option is not provided. However, nowadays, insurers offer features like return of premium that comes with free of cost benefit under special exit value~1. This may attract additional cost, though.

No. Life insurance does not cover deaths of all types. Usually, life insurance policies cover natural death due to illness, accident, and violence etc. Death due to suicide is generally not covered by life insurance policies in India before the waiting period is over. This period usually spans over an year from the date of policy commencement. Also, death due to engaging in life-threatening activities like sky-diving and cliff-jumping, are also not covered against.

Basic exclusions in term insurance include death due to undisclosed pre-existing conditions, self-inflicted injuries, engaging in life-threatening sports/activities, war, or nuclear accidents. However, suicidal death may be covered after a minimum period of 1 year from the policy commencement date.

Yes, accidental deaths are covered by term insurance. Life insured can choose for their nominee to receive the sum assured as a lump sum or monthly pay-outs or both in parts. All these conditions are mentioned in the policy document which must be read carefully at the time of purchase and referred to, when required.

The biggest advantage of term insurance is getting good life cover at affordable premium rates. Term insurance plans in India are the cheapest forms of life insurance one can lay their hands on. Also, the premiums paid up to Rs 1.5 lakhs per annum (u/s 80C) as well as the sum assured received is exempt from taxes u/s 10 (10d) of the Income Tax Act, 1961.

To buy term life insurance online, you can visit the insurance company's website and fill in your details. Mostly your age, income, and lifestyle is asked by the insurer to proceed.

Then you need to select a suitable term plan, choose the sum assured amount, add riders if applicable, choose payment term, and complete the payment. If medical tests are required, insurers ask you to go through those and upload the reports. Younger, healthy individuals don’t have to get any medical tests done.

Upon approval, policy documents are shared with you. You should ideally read the policy document carefully. Most policies give you a 15-30 days of free-look period. This means if you’re not satisfied, you can cancel the policy for a full refund of the premium paid.

ARN: PCP/TIP/131224

•

•

•

•

•

“Axis Max Life has helped me to identify the best term plan with adequate Life Cover for protecting my family’s future financial and giving me the peace to enjoy my present existence in this earth. Axis Max Life has helped me to save through Endowment plans, thereby giving me a Guaranteed money at different stages of my life”

P. Kesavan

“Over all online policy purchase process was easy and purpose form filling process was easy and online premium payment process was easy”

Zaid Anwar

“Axis Max Life Term Plan is first proper Term Plan to take care of me and my Family. With Axis Max Life, I am at Peace of Mind with Axis Max Life. I trust you and your Processes. I am Happy to have this Relationship. Manoj”

Manoj Chandwani

“Life Insurance Products provide arrangements for future events and there are various requirements at different life stages. For events that are to occur beyond 10 yrs, Life Insurance products are the only option. Keeping above in mind, I have Term Insurance, Endowment products taken almost 19 yrs ago and they will give Tax Free Lump sum amounts; I have Guaranteed Income Products and also Annuity Plan. For little better return on my investment I have ULIP plans. I have products, that will provide 25 - 50 thousand every year on my Grand Children’s birthdate - Annual Gift from grandparents when we will not be around”

Ashok Shah

“I had one endowment plan and one term plan with axis-maxlife and I believe in making the difference with the help of AXIS-MAXLIFE”

Satish Kumar

“Thanks for the opportunity to secure life with Axis Max Life, the best term plan comparatively in the market which i opted today and seen that, this plan assisting many with the good claim settlement ratio by Axis Max Life a trusted term insurance company.”

Naresh Vattela

“My experience has been great with Axis Max Life Term Plan. I truly believe that it is the best term insurance that I have chosen for financial security.”

Roshni Mudliyar

“I bought the best Axis Max Life Smart Secure Term Plan! from your team. Thanks for the assistance. ”

Kiran K

Was the Information Helpful?

Very Good

Term insurance provides your loved ones with the required financial security…

Read More

Term insurance covers natural, accidental death, or death due to some illness…

Read More

If you are no longer around… how will your family cope with the bills?

Read MoreTerm insurance premium is referred to as the money you pay to your insurer in exchange for life coverage. You may be paying the policy premium monthly, quarterly, semi-annually, or annually to ensure that your protection remain in-force. It is wise to get a term plan at a young age to start paying the minimum premium possible every year.

Sum assured refer to the protection or coverage your term plan offers to your designated nominee in the event of your demise, provided the policy terms and conditions (T&Cs) are met. In general, the higher the coverage you seek, the higher the premium you pay in exchange. In today’s age, a minimum of 2-Crore Term Plan is highly recommended.

Term insurance plans, typically, offer the death benefit to your nominee in case of your demise as per the policy T&Cs. Riders are optional add-ons that enhance your basic term plan coverage and can be opted for in exchange for a small additional premium payment. Some must-buy riders available with term plans are critical illness, waiver of premium, and accidental death and disability rider.

The primary benefit or a term plan is that your nominee becomes entitled to the sum assured, which is payable upon your demise by your insurer, in exchange for the premiums you pay periodically. This sum assured can be a great monetary help to your dependents when you not there anymore to support their everyday needs.

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Do you have any thoughts you’d like to share?