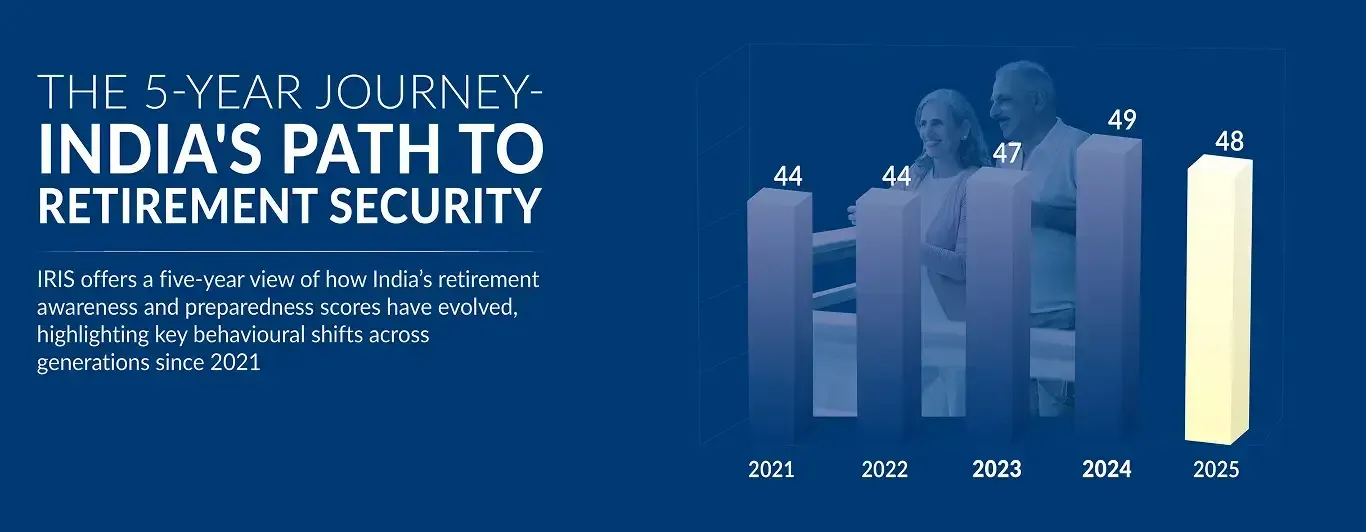

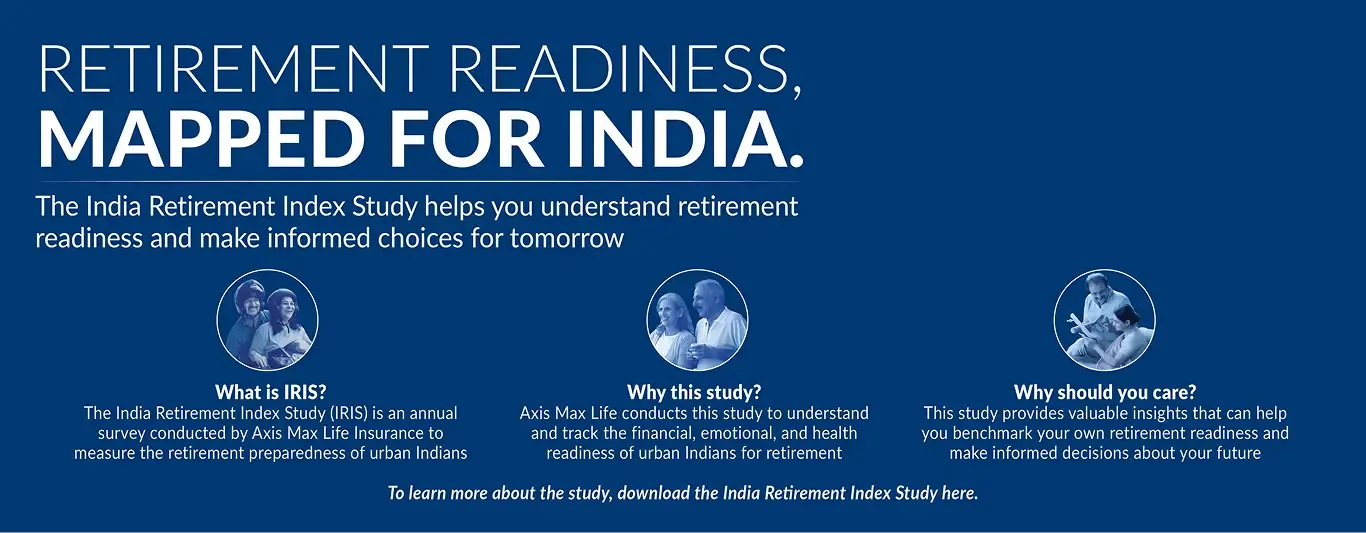

Did You Know?The IRIS Index has become a yardstick to measure India’s retirement preparedness across the complete paradigm of retirement ecosystem. The Retirement Index is the degree to which Indians feel prepared for tomorrow’s retired life on a scale of 0 to 100. There are three key indices of IRIS –– financial, health and emotional.

The ₹1 Crore Retirement Illusion

77% of urban Indians believe ₹1 Crore or less is enough for a peaceful retirement— a gross underestimation that severely ignores decades of inflationary pressure.

Dreaming Healthy, Living Sedentary?

An overwhelming 79% of urban Indians visualize a healthy retirement, yet 60% acknowledge a serious gap by admitting they currently live a sedentary lifestyle.

Retirement: A Socially-Driven Goal?

73% of urban Indians require a social nudge— specifically recommendations from friends and family—to finally begin their retirement savings journey

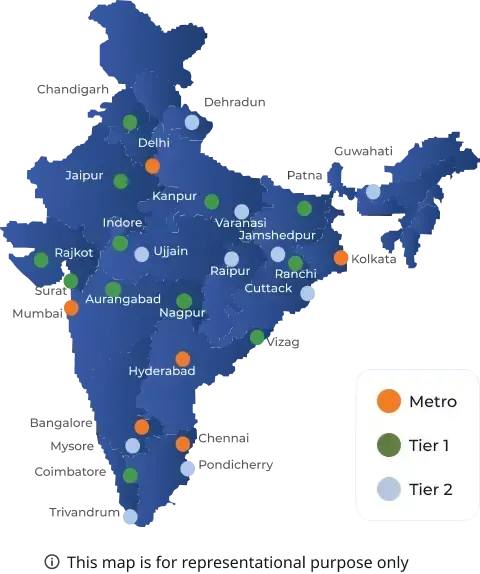

IRIS Survey Details

IRIS, one of India’s leading retirement-focused surveys now enters its 5th editionSample Size2242 households

Cities28 cities

Field-work durationJul’25-Aug’25

Respondent Profile25-65, SEC A/B, working individuals

MethodologySelf-Administered Digital Study

What Do These Terms Mean?

Key Findings of IRIS 5.0

Retirement is overwhelmingly viewed as a positive phase with nearly half (46%) expecting more family time, and 43% anticipating greater independence.

Despite half of the population (51%) stating that retirement should be the first financial goal, a full 24% are guilty of severe inertia, having made zero progress toward saving.

65% respondents view Life Insurance as a suitable and key product for effective retirement planning.

75% of people consider annuity and regular income savings as suitable products for retirement planning.

A sobering 50% of urban Indians believe that they will be reliant on family wealth or their children to fund their retirement.

The psychological burden of retirement is massive with around 70% of urban Indians under 50 fear being alone in their retired years.

44% Of Gig Workers invest in health insurance which is 6% lower than the national average

39% of women are confident that their retirement kitty will last more than a decade.

From Term Insurance to Retirement Planning, we've got comprehensive solutions tailored for Indian families

Contact Us

if you got any question for us?Connect on WhatsApp

+91 7424396005

Mail to

service.helpdesk@axismaxlife.com

Customer Care

1860 120 5577

For On-going Applications/Buying a New Plan

0124 648 8900