- Home>

- Axis Max Life IPQ

Steady Increase in IPQ Seen in Last 7 Years

Urban India feels increasingly secure about its financial preparedness

IPQ 7.0

48

IPQ 6.0

45

IPQ 5.0

43

IPQ 3.0

39

IPQ 2.0

35

IPQ 1.0

35

Disclaimer: IPQ 4.0 was conducted during COVID under a different methodology

What does IPQ stand for?

What is the IPQ 7.0 score?

India significantly feeling more financially secure on the back of

increasing Life Insurance Knowledge and Ownership levels

increasing Life Insurance Knowledge and Ownership levels

Knowledge Index

57

LI Ownership

73%

Security Level

63%

Knowledge Index

61

LI Ownership

75%

Security Level

65%

Knowledge Index

63

LI Ownership

78%

Security Level

68%

Key Findings from IPQ 7.0

Did you know?

- Medical expenses & financing family’s aspirations are urban India’s top anxieties

- Saving for children’s future needs continue to dominate as an objective for Savings

Explore Axis Max Life plans that help you protect your family’s financial future Click here

Sample Size

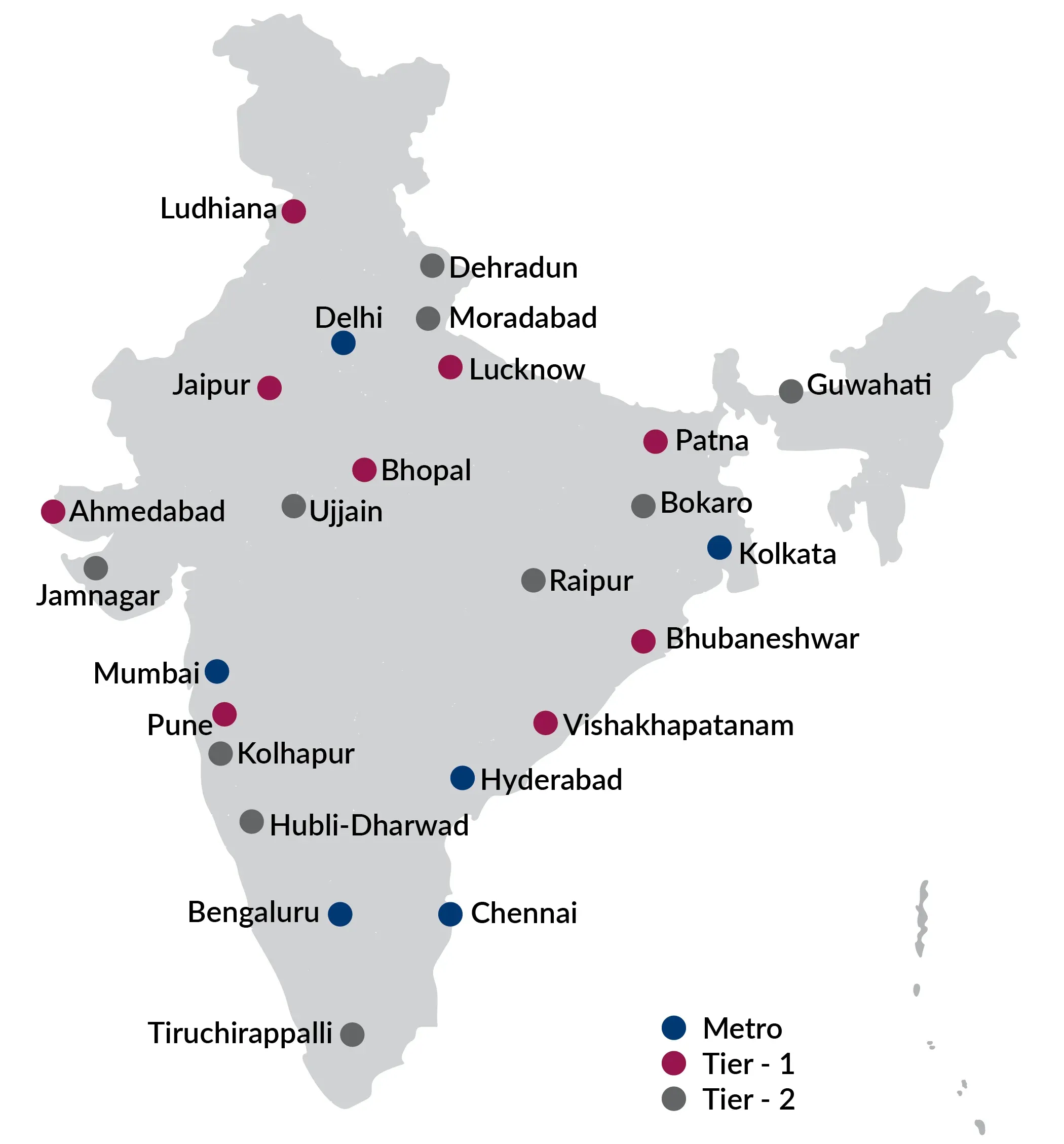

IPQ 7.0, with the mission to bring Protection for all, reaches out to a vast population across India, tapping into different segments to hear their financial stories.

Contact us

Got a question for us?

Connect with us on WhatsApp

+91 7428396005Customer Care

1860 120 5577

FAQ’s

What is IPQ?

IPQ is a yearly financial study for Urban India undertaken by Axis Max Life Insurance in collaboration with Kantar. It is a primary research survey covering 7000+ respondents, across 25 cities, covering different segments of the population, across the length and breadth of the country. The aim of undertaking this survey is to gauge and chart the progress made by average urban Indians with respect to their financial protection, in the context of adopting life insurance for safeguarding their future in case of any unforeseeable situation.

How is the IPQ survey conducted?

IPQ is a primary research that is undertaken in 2 modules: physically-administered survey (giving us the IPQ score) and digitally-administered survey (giving us IPQ Digital score). The entire field work spans more than a month and is administered and supervised by KANTAR.

Who all did IPQ reach out to?

IPQ 7.0 reached out to 7000 households across 25 cities (6 metros, 9 Tier I, 10 Tier 2 cities), and 25 villages covering males, females & LGBTQIA+ from the salaried, self-employed & gig worker cohorts. Demographics include: NCCS AB and ages 22-55.

How is the IPQ score calculated?

The IPQ score is calculated based on responses by respondents to a battery of questions that indicate their levels of awareness and ownership in the life insurance category along with their levels of security/anxiety with respect to their financial protection against unforeseeable risks. Questions are classified into Knowledge Index, Ownership Level, and Security Level and these get combined to create the India Protection Quotient.

How is the IPQ 7.0 score?

IPQ score has seen a rise of 3 points from 45 to 48. Increase in Knowledge Levels seen as they climb from 61 to 63. Ownership level rises significantly from 75 to 78 and Security levels rise from 65 to 68.