- Home>

- Blog>

- Investment Plans>

- Gold Mutual Funds

Trust of 20+ Years in Industry

Written bySumit Narula

Investment Writer

Published 16th October 2023

Reviewed byPrateek Pandey

Last Modified 29th October 2025

Investment Expert

What is Gold Mutual Funds Definition?

Gold Mutual Funds can be defined as a category of mutual fund that primarily makes various gold investments such as physical gold bullion, gold exchange traded funds or equity stocks of gold mining and/or refining companies. As a result, changes in the domestic or international price of gold impacts the performance of the investment.

This make gold funds an ideal hedging investment option whose price has historically featured a negative co-relation to the performance of equity markets. This means that when equity markets witness a slowdown, gold prices have historically increased and aided the preservation of wealth. What’s more, gold prices have a positive correlation to inflation, so historically gold fund investment returns have also kept pace with inflation in the long-term.

How Do Gold Funds Work?

The primary investment of Gold Mutual Funds can include gold bullion i.e. physical gold bars or stocks of gold mining/refining companies and even Exchange Traded Funds (ETFs) that invest in physical gold or stocks of gold mining/refining companies. Apart from this, gold funds may also invest a relatively smaller portion of their investible assets in cash, cash-equivalent instruments or debt instruments to help maintain adequate liquidity. This portfolio of assets is managed by a professional fund manager similar to other types of mutual funds and exchange the fund house charges investors a few in the form of an expense ratio.

So an investor who invests in a gold fund gets benefits similar to investing in physical gold but without having to pay expensive charges related to security and storage of physical gold. What’s more, unlike physical gold, these gold investments are significantly more liquid i.e. the units of a gold mutual fund are easier to convert into cash through redemption with the fund house or on the stock market. This feature allows using gold funds as a possible source of emergency funds by investors.

Benefits of Gold Fund Investments

Gold mutual funds as an investment option in India offers a few unique benefits to investors. Below are some of the key features and benefits of this investment:

Accessibility

Gold funds offer an accessible and streamlined approach to investing in gold. Unlike the traditional method of buying physical gold, which might involve concerns about purity, storage and insurance, gold mutual funds allow investors to make gold-based investments seamlessly. Additionally, units of gold funds are accessible to not only large investors but also to those who wish to start investing with even amounts as low as Rs. 100.

Liquidity

The ease of buying and selling units in gold funds makes them highly liquid. While physical gold may involve delays in buying or selling, gold funds provide immediate transaction capability directly with the fund house itself. This liquidity feature enhances their appeal as a versatile investment option.

Diversification

Investing in gold funds enables investors to implement portfolio diversification into various gold-related avenues like bullion, gold mining/refining stocks, and even derivatives like gold ETFs. This makes gold mutual funds a viable tool for asset allocation to help in mitigating overall investment risk in the portfolio and can contribute to more getting optimal returns over various investment tenures.

Professional Management

With gold funds, investors benefit from the expertise of professional fund managers. These experts meticulously monitor market trends, and economic indicators, and employ various data-driven strategies to optimize the performance of the scheme. This professional management ensures that investments align with prevailing market conditions and increasing potential growth of investor’s wealth.

Key Features of Gold Mutual Funds

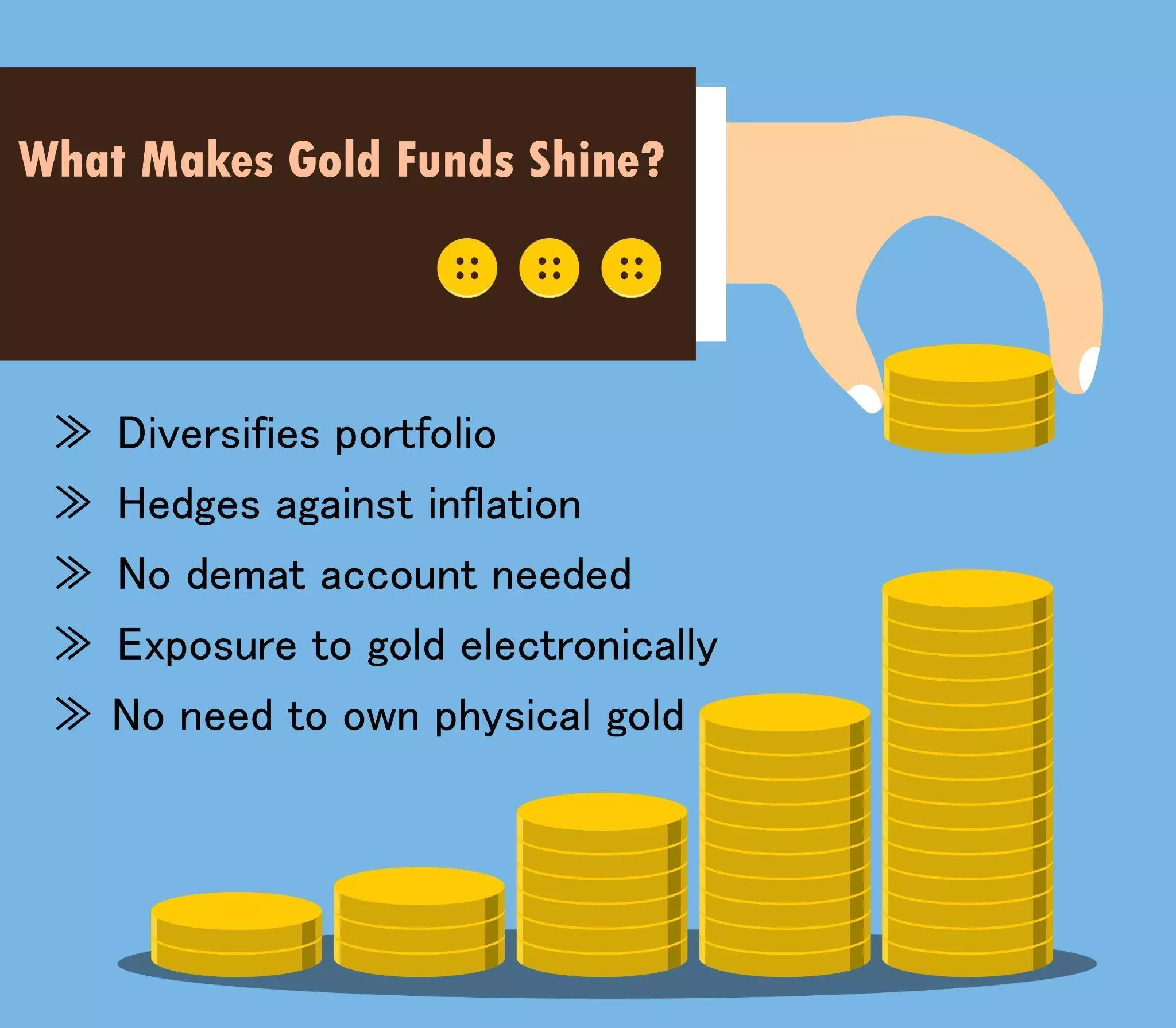

Below are some of the key reasons why investors should consider including gold funds in their investment portfolio:

Hedge against inflation

Historically, gold has served as a protection against inflation. Gold funds, providing exposure to this precious metal, can be a strategic tool to preserve wealth during periods of high inflation. This inflation-hedging capability distinguishes gold funds as a valuable investment option.

Portfolio diversification

By incorporating gold funds into an investment portfolio, investors can achieve diversification. Since gold usually bears a negative correlation to equity and debt investment performance, it can reduce overall portfolio risk and enhance the portfolio's resilience against market fluctuations.

Potential for growth

Especially during uncertain economic times, gold funds can offer a balance between risk and reward. During periods of economic turmoil gold-based investments have the potential to deliver high growth and stabilize the performance of an investment portfolio when other asset classes are more volatile.

Flexibility

Gold funds are not restricted to large investors they provide an opportunity for small investors as well. The flexibility of investing as little as Rs. 100 and a much larger amount either through lump sum investment or systematic plans, makes gold funds an adaptable investment vehicle that caters to a wide range of financial capabilities and needs.

How to Select Gold Funds for Investment?

Below are some key steps that you can follow to select a suitable gold mutual fund to invest in:

Understanding your investment goals

Investing in gold funds requires alignment with personal investment objectives, risk preferences, and financial needs. A clear understanding of these aspects ensures that the chosen gold funds suit your unique financial landscape.

Researching various gold funds

Different gold funds have distinct investment strategies, performance histories, and fee structures. A thorough investigation of these factors, alongside a comparison based on individual needs, guides a more informed investment decision.

Analysing risk and return

Assessing the risk and return profile of gold funds helps align them with financial expectations and risk tolerance. A careful analysis ensures that the selected funds match the investor's comfort level and long-term objectives.

How are Gold Mutual Fund Returns Taxed in India?

From a taxation perspective, gold funds are considered as non-equity investments so their tax treatment is similar to debt mutual funds in India. For gold fund units purchased prior to April 1, 2023, short-term capital gains taxation rules were applicable if units were redeemed prior to completion of 3 years, while gains from units redeemed after 3 year were considered as long term gains. As per this rule of tax on mutual funds, the short-term capital gains were taxed as per the income tax slab rate of the investor. The tax rate on long term gains from gold funds was 20% with indexation benefit.

For gold fund units purchased on or after April 1, 2023, only a single tax rate is applicable on both short and long term gains. As per this rule, all gains from redemption of gold funds are taxable as per the income tax slab rate of the investor for the applicable financial year.

FAQs Related to Gold Funds

Do I need a Demat Account to invest in gold mutual funds?

No Demat account is not mandatory for investing in gold mutual funds. However, it is mandatory if you are investing in De-materialized units of gold funds or Gold ETFs through the stock market?

Does gold fund NAV change every day?

Like other mutual funds, Net Asset Value (NAV) of gold mutual funds is calculated at the end of each trading day. So, the NAV of gold fund units can change at the end of each day when markets are open.

What are the charges associated with gold mutual fund investments?

The main charge associated with investing in gold funds is the expense ratio or total expense ratio of the scheme that is declared by the fund house from time to time. Apart from this, each investment and redemption also features a Securities Transaction Tax (STT) as per the applicable government rate.

Can I invest in gold funds via a SIP?

Yes, you can invest in gold plans via systematic investment plan (SIP). However, the minimum SIP installment amount and SIP investment duration can differ from one fund house to another.

Can I get assured returns from gold mutual funds?

No, gold mutual fund performance is directly linked to the price of gold that can fluctuate on a daily basis. So, gold funds do not offer guaranteed returns.

ARN: Nov23/Bg/04G

Sources:

groww.in/p/gold-funds

www.paytmmoney.com/blog/gold-mutual-funds/

m.economictimes.com/industry/banking/finance/banking/what-are-gold-funds-and-what-are-their-benefits/articleshow/98307033.cms

cleartax.in/s/gold-etfs

www.rankmf.com/knowledge-center/article/what-are-gold-mutual-funds/

mf.nipponindiaim.com/mutual-fund-articles/gold-funds-and-its-benefits

groww.in/p/gold-funds

www.paytmmoney.com/blog/gold-mutual-funds/

m.economictimes.com/industry/banking/finance/banking/what-are-gold-funds-and-what-are-their-benefits/articleshow/98307033.cms

cleartax.in/s/gold-etfs

www.rankmf.com/knowledge-center/article/what-are-gold-mutual-funds/

mf.nipponindiaim.com/mutual-fund-articles/gold-funds-and-its-benefits

Popular Searches

Online Sales Helpline

- Whatsapp: 7428396005Send ‘Quick Help’ from your registered mobile number

- Phone: 0124 648 890009:30 AM to 06:30 PM

(Monday to Sunday except National Holidays) - service.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.

Customer Service

- Whatsapp: 7428396005Send ‘Hi’ from your registered mobile number

- 1860 120 55779:00 AM to 6:00 PM

(Monday to Saturday) - service.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.

NRI Helpdesk

- +91 11 71025900, +91 11 61329950 (Available 24X7 Monday to Sunday)

- nri.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.