#Retirement

Retirement Planning Blogs

Retirement Planning Blogs

Recent Articles

#retirement-planning

At a younger age, most of us do not think of retirement planning as a financial priority. But, as you approach the age of retirement, you may find yourself hurrying to save enough money for it. It is in your best interest to create an efficient financial plan today by finding the type of pension plan suitable to you.

Continue Reading#retirement-planning

A small monthly pension can support basic expenses in the post-retirement period. Thus, many people aim to avail of at least ₹ 5,000 per month as a pension. This guide explains how you can plan your savings and build a retirement corpus.

Planning for a retirement corpus is a long-term financial goal. Hence, many earners want a simple plan, such as a ₹ 5,000 pension per month in retirement. You can achieve this goal with consistent savings and pre-planned investments. For these, you must take some strategic steps that can ensure the stable growth of your wealth.

This guide will help you plan your corpus by choosing the right pension tools

Continue ReadingPlanning for a retirement corpus is a long-term financial goal. Hence, many earners want a simple plan, such as a ₹ 5,000 pension per month in retirement. You can achieve this goal with consistent savings and pre-planned investments. For these, you must take some strategic steps that can ensure the stable growth of your wealth.

This guide will help you plan your corpus by choosing the right pension tools

#retirement-planning

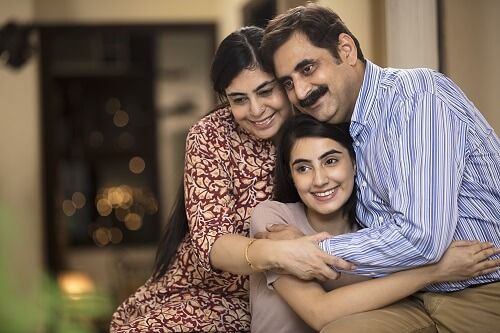

A successful career is a stepping stone to a comfortable retirement after you turn 60. However, with a smart savings habit, you can build a corpus and actually retire by 40. This entails developing financial independence by 40 to live the rest of your life without worrying about income and expenses. Wondering how? Keep scrolling for a detailed guide!

Continue Reading#retirement-planning

Who does not want a comfortable retirement! For many, a ₹50,000 pension per month can mean living a retirement life with all the basic comforts. It is enough to meet basic living expenses, medical needs, and lifestyle costs in current times for those who choose to live a lean retirement.

Through this guide, we will help you understand how to get ₹50,000 pension per month with careful planning and an investment mindset.

Continue ReadingThrough this guide, we will help you understand how to get ₹50,000 pension per month with careful planning and an investment mindset.

#retirement-planning

Due to the rising cost of healthcare and the uncertainty of market returns, financial security in retirement has become a main concern. Fixed deposits or provident funds may provide some safety, but they cannot ensure a lifelong, regular income.

That's where annuity plans have a role to play. For 2026, insurers and financial institutions have come up with better annuity products, factored for different stages of life and needs.

Continue ReadingThat's where annuity plans have a role to play. For 2026, insurers and financial institutions have come up with better annuity products, factored for different stages of life and needs.

Showing page 1 of 13

Popular Articles

Most Popular Article

Continue reading Popular ArticlesView All Articles

#Retirement

#Retirement

#Retirement

#Retirement

Videos for You